Effortless Invoicing: Creating Invoices in Skhokho's Business Management Software

As a business owner or entrepreneur, invoicing is a critical part of your day-to-day operations. Invoicing not only ensures that you get paid for the goods and services you provide, but it also helps you keep track of your finances and maintain a healthy cash flow. In the past, small businesses had to rely on manual processes or clunky software to create invoices. This often meant spending hours on paperwork, chasing down payments, and dealing with accounting errors.

Thankfully, technology has come a long way in recent years, and invoicing software has become more sophisticated and streamlined. Skhokho's Business Management Software is a prime example of how modern software can help make invoicing effortless for small businesses. With its built-in accounting module and invoicing capabilities, Skhokho is designed to simplify the invoicing process and help business owners focus on what they do best.

In this blog post, we'll provide a step-by-step guide to creating invoices in Skhokho's Business Management Software. We will cover the following topics:

- Evolution of invoicing for small businesses

- Step by step guide to creating an invoice on Skhokho

- Benefits of using Skhokho invoicing Software

- WhatsApp interface - Invoicing on the go

- Getting started with Skhokho

The evolution of invoicing for small businesses and how Skhokho is helping to revolutionize the process

Invoicing used to be a manual process, requiring businesses to create paper invoices and mail them to their clients, then manually record the payment once it was received. This process was time-consuming and often resulted in errors, such as lost or misplaced invoices, payment discrepancies, and delayed payment processing.

The introduction of personal computers and the internet revolutionized invoicing for small businesses. Invoicing software, such as QuickBooks and FreshBooks, provided a more efficient way for businesses to create, send, and manage invoices. This software allowed businesses to customize their invoices, track payment due dates, and monitor outstanding balances. However, many invoicing software programs were designed for accountants and not intuitive for business owners without accounting backgrounds.

Today, the trend is towards business management software, which includes invoicing modules. Skhokho's Business Management Software is an excellent example of a solution that is helping to revolutionize the invoicing process. Skhokho's software is designed to be user-friendly, making it easy for business owners to create and manage their invoices.

With Skhokho, businesses can create invoices quickly, add the client's details, and specify the payment terms. The software also has an option to send the invoice directly to the client via email or download it as a PDF. Skhokho also makes it easy to keep track of invoices and payments, so business owners always know where they stand financially. Skhokho provides real-time insights and reporting that helps business owners and entrepreneurs make informed financial decisions.

Moreover, Skhokho's software allows businesses to automate their invoicing process by setting up recurring invoices and payment reminders. This functionality ensures that businesses receive payments on time, minimizing the need for manual follow-up. This feature helps ensure that cash flow stays healthy, so businesses can focus on growing their operations.

Step by Step guide to creating your business invoice on Skhokho Business Management Software

Step 1: Create company profile

Creating a client profile is an essential step in maintaining accurate financial records and establishing strong relationships with your customers. By having a comprehensive database of client information, you can easily access and manage their contact information, payment terms, and outstanding balances. This will enable you to provide your customers with a more personalized and efficient service, which can lead to increased customer satisfaction and loyalty.

Moreover, creating a client profile provides you with valuable insights into your business operations. By associating invoices with specific customers, you can analyze which customers are generating the most revenue, which customers are the most profitable, and how much money you make per customer. This information can help you make informed business decisions, such as identifying areas where you can improve your services or products or determining which customers to focus on to maximize revenue.

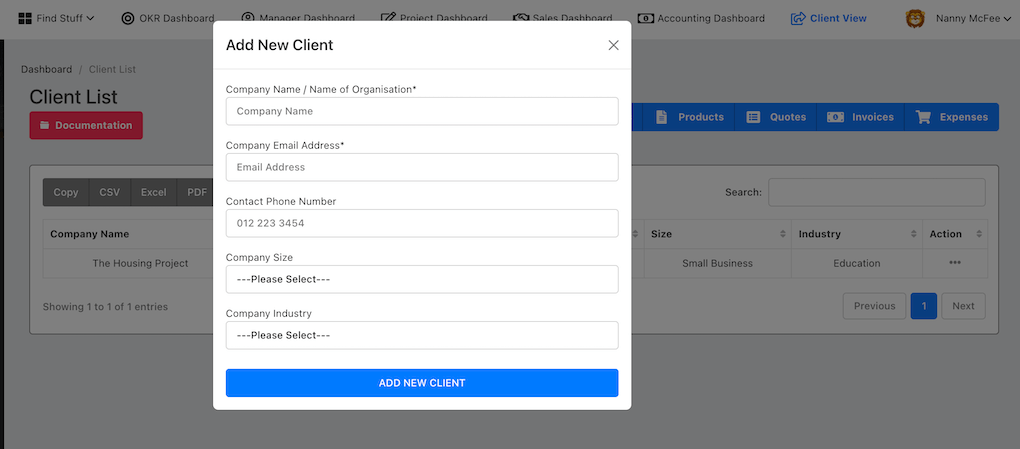

Navigate to the client-list page of the invoicing app and select: create new client

Creating a client profile is also a critical step in streamlining the invoicing process. Once you have entered the customer's information, you can easily create and send invoices by selecting the customer from a drop-down list. This can save you a significant amount of time and effort, particularly if you have numerous clients. Moreover, by having all your client information in one place, you can easily track which invoices have been paid, which are overdue, and which are outstanding. This provides you with a better overview of your business's financial health and enables you to stay on top of your cash flow management.

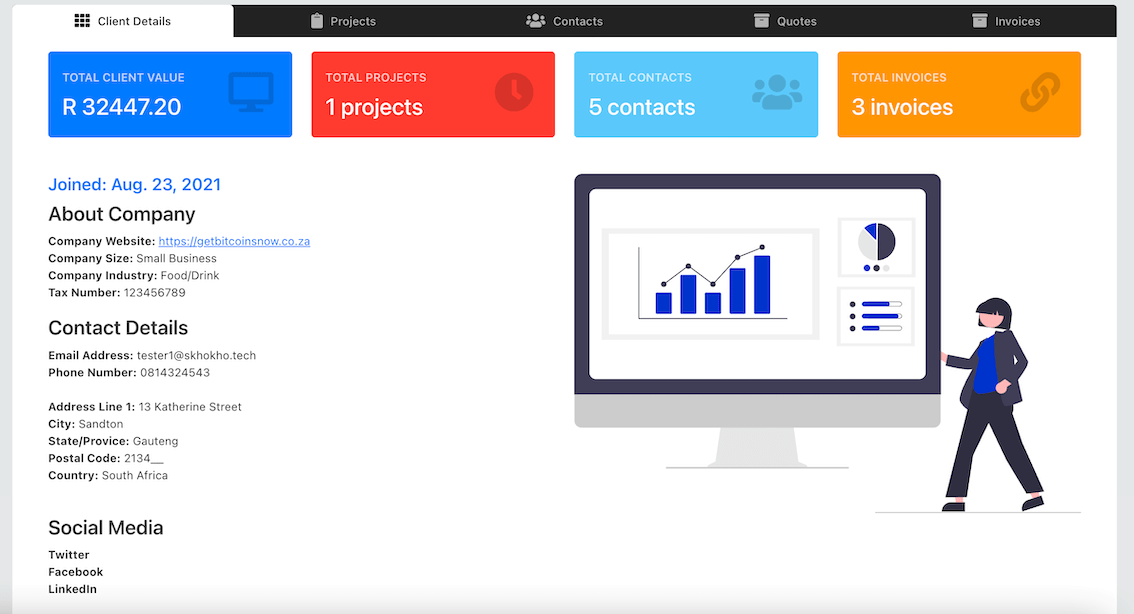

Client profile page looks like:

From the client profile page, you can view the following:

- Total invoices issued to the client and their status

- Total quotes issued to the client and their status

- Number of projects created for that client

- Names and contact information for individuals within the client organisation such as project managers, etc.

Step 2: Add new invoice

You can now add invoices. Navigate to the invoice list page to get started.

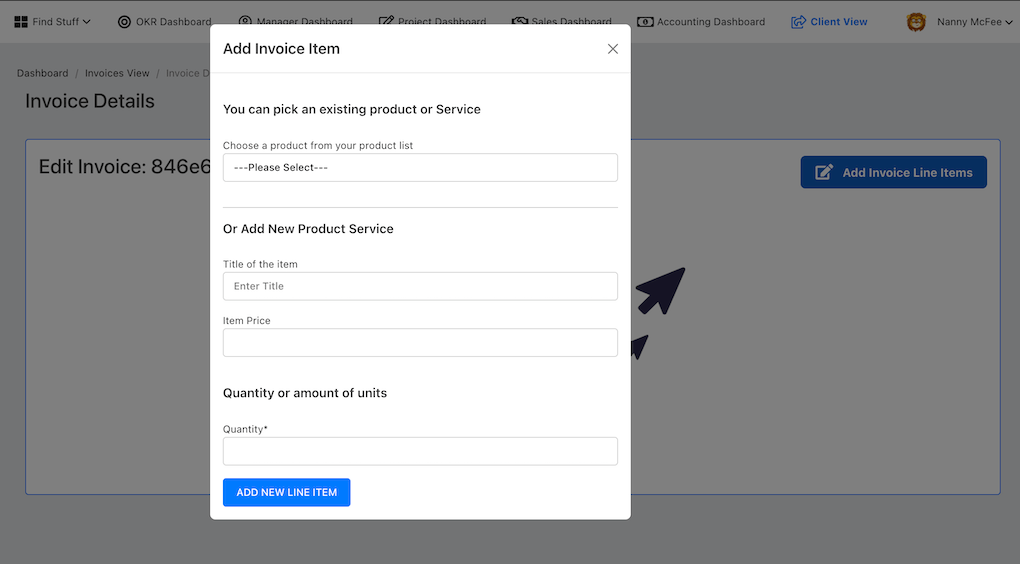

Click on “Create” at the top of the page. A blank invoice will be created - at this stage start by adding invoice line items.

Select the product, add price and quantity and save the form.

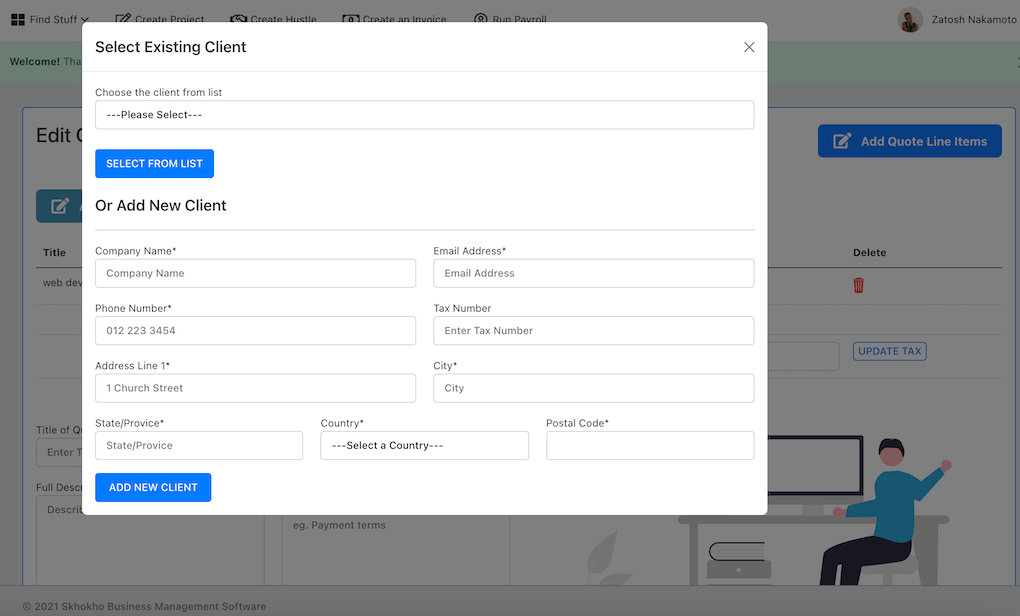

Then add client to the invoice - you will be able to select a client from drop-down list from clients added in step 1 above.

Alternatively, you can add a new client if one does not exists in your dropdown.

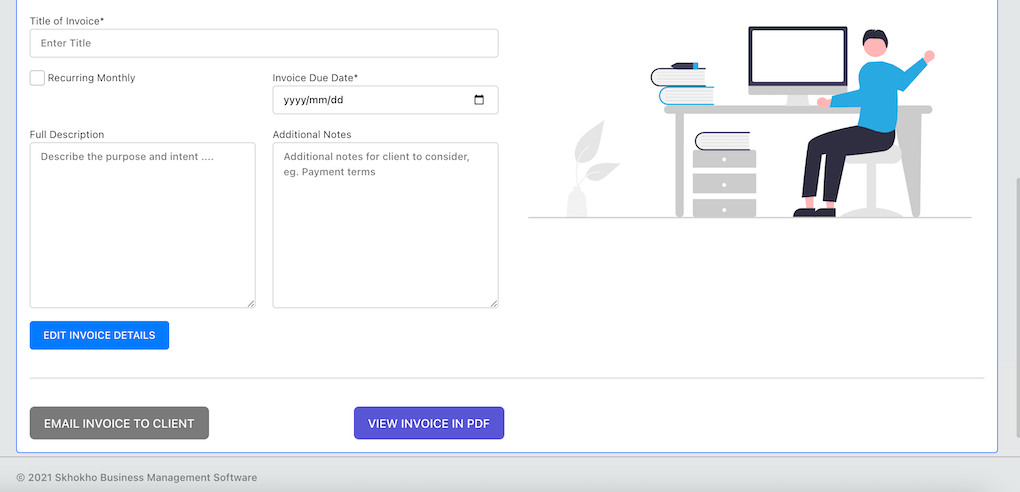

Add invoice details:

- Title of invoice

- Description of invoice

- Additional Notes

- Select if it is a recurring invoice and if so, which date the invoice must recur.

Alternative Options for creating an invoice

Use CSV Upload: If you want to add invoices in bulk at a given time. You can save the information in an excel document and upload it as a CSV file for convenience.

Transfer data using Zapier: Alternatively you can transfer invoice data from any other accounting software available on Zapier, Google Sheets or even a Google Form using Zapier.

Step 3 - Download Invoice

Once your invoice has been created, you can either: (1) download a PDF version of the invoice or (2) Immediately email the invoice to the client.

Note you can enter your SMTP records in to Skhokho so when you invoice your client, the invoice comes from your email address and the client knows the invoice is from your domain.

Benefits of using Skhokho Invoicing Software for your business

Skhokho Invoicing Software offers several benefits. Here are the top benefits associated with Skhokho invoicing software:

- Saves time: Skhokho Invoicing Software is designed to be user-friendly, with an intuitive interface that makes it easy to create and send invoices. With Skhokho, businesses can save time on the invoicing process, which can be spent on other critical tasks, such as generating new leads or providing excellent customer service. According to a recent study, businesses that use online invoicing software save an average of 5.5 hours per week, which can add up to substantial savings over time.

- Improves accuracy: Skhokho Invoicing Software reduces the risk of errors and omissions, which can result in incorrect invoices, delayed payments, and poor cash flow. By automating the invoicing process, Skhokho ensures that invoices are sent to the right clients with the correct details, resulting in fewer mistakes and greater accuracy.

- Increases cash flow: Skhokho Invoicing Software provides businesses with the tools they need to manage their invoicing and payment processes effectively. By sending reminders for overdue payments, setting up recurring invoices, and providing real-time insights into cash flow, Skhokho helps businesses maintain a healthy cash flow and reduce the risk of cash flow problems.

- Provides real-time reporting: Skhokho Invoicing Software provides businesses with real-time insights into their invoicing and payment processes. This information can be used to make informed business decisions, such as identifying profitable customers, analyzing cash flow, and optimizing pricing strategies.

Studies showed that mall businesses that use invoicing software get paid 11 days faster on average than those that don't. Additionally, businesses that use invoicing software can reduce their administrative costs by up to 40% and increase their revenue by up to 3.3%. These statistics demonstrate the financial benefits of using Skhokho Invoicing Software for businesses, including faster payment processing, reduced costs, and increased revenue.

Skhokho WhatsApp Interface - Invoiced on the go

Skhokho Invoicing app now includes a WhatsApp interface, which allows users to create and send invoices through the popular messaging platform. This new feature was designed to make invoicing more accessible and inclusive, as users can now create invoices from their mobile devices without the need for a laptop or desktop computer.

Here's how the process works:

- Enter invoice details: To create an invoice using the WhatsApp interface, you need to send a message to Skhokho's WhatsApp number. Skhokho will then guide you through the process of collecting the required information for your invoice. We will collect information about the customer, item descriptions, quantity, and price.

- Review and confirm: After you have sent the invoice details to Skhokho, we will automatically generate an invoice and send it back to you via a document link. You can then review the invoice and confirm that all details are correct before sending it to the customer.

- Send the invoice: Once you have reviewed and confirmed the invoice, you can send it to your customer via WhatsApp, email, or any other preferred method. The customer will then receive the invoice and can make payment according to the terms specified.

The Skhokho Invoicing app's WhatsApp interface makes it easy for businesses to create and send invoices from their mobile devices. This can be particularly beneficial for small business owners who are always on the go and need to manage their invoicing and payment processes from anywhere. By simplifying the invoicing process, the app can help users save time and increase their efficiency, while also providing an inclusive and accessible solution for all business owners.

Getting started with Skhokho Invoicing Software

Get started by registering for a no-obligations free trial. No credit card is required and you can enjoy all the features of Skhokho Business Software. Register here: https://skhokho.io/authentication/register

Read Skhokho Documentation: https://skhokho.io/documentation/guide/