How Budgeting and Financial Forecasting Can Drive Small Business Growth

According to the U.S. Small Business Administration, approximately 20% of small businesses fail within the first year, and about 50% fail within five years. These staggering statistics highlight a critical issue that many entrepreneurs face: the lack of strategic financial planning. Have you ever wondered why some businesses effortlessly thrive while others struggle to stay afloat? The answer often lies in their approach to budgeting and financial forecasting.

The modern business landscape is increasingly competitive, and the ability to navigate financial uncertainties has never been more crucial. With fluctuating markets and unpredictable economic conditions, small businesses are frequently challenged to maintain financial stability. Consequently, understanding the nuances of budgeting and projecting future income and expenses is essential. These financial competencies are not just tools for survival, but keys to unlocking avenues for growth and expansion.

Many small businesses operate in the moment, often overlooking the significance of structured budgeting. Unbeknownst to them, planning ahead is crucial—not just for organization, but as a strategic tool for fostering growth. Effective budgeting and forecasting go beyond mere preparation; they are foundational to enabling a business to flourish in a competitive environment. On this article we will focus on the following:

- Budgeting, The Roadmap to Stability

- The Power of Financial Forecasting: Planning for Growth

- Understanding Budgeting and Financial Forecasting

- Importance of Budgeting and Forecasting

- Practical Applications

- Challenges & Solutions

- Future Outlook

Budgeting, The Roadmap to Stability

Furthermore, a well-structured budget serves as a roadmap, guiding business owners through the complexities of their financial landscape. It assists in identifying potential pitfalls and opportunities, helping to allocate resources efficiently and make informed decisions. A survey by QuickBooks found that 60% of small business owners do not keep a formal budget, leading to overspending and cash flow issues. This highlights the dire need for mastering budgeting skills in order to achieve long-term stability.

However, it is essential to acknowledge that budgeting is not without its challenges. Many entrepreneurs find it overwhelming to create accurate financial projections, often due to a lack of experience or resources. The pressure can lead to errors that may have significant repercussions.

The Power of Financial Forecasting: Planning for Growth

Financial forecasting, on the other hand, allows businesses to anticipate changes and plan accordingly. According to a study from the Business Development Bank of Canada, companies that engage in regular financial forecasting increase their revenue by an average of 20% more than their counterparts who do not. This statistic underscores the significance of being proactive about financial management, as it empowers businesses to adapt to market trends and consumer behavior. Moreover, some business owners may resist the incorporation of these financial practices, viewing them as time-consuming or unnecessary.

A survey from SCORE revealed that 30% of small business owners believe that their financial health is strong enough without a formal budgeting strategy. However, this perspective can be short-sighted, especially in a rapidly changing economic environment where agility and foresight can determine a business's capacity to evolve and grow. In light of these considerations, the importance of mastering budgeting and financial forecasting becomes evident. They are not mere administrative tasks, but critical components of strategic planning that can mean the difference between mediocrity and success.

Understanding Budgeting and Financial Forecasting

Budgeting is a crucial aspect of financial management that involves the process of creating a plan to spend your money. This plan helps to allocate resources, prioritize expenses, and set financial goals to ensure sustainability and growth. On the other hand, financial forecasting involves predicting future financial outcomes based on historical data, current financial conditions, and anticipated changes. It is essentially a projection tool that provides insight into expected revenue and expenses, helping organizations prepare for varying financial scenarios.

Key Concepts

- Operating Budget: One of the cornerstone components of effective budgeting is the operating budget. This is a comprehensive financial plan that outlines an organization’s revenue and expenses over a specific period, usually yearly. It encompasses all operational aspects, such as salaries, utilities, supplies, and administrative costs. According to the Small Business Administration (SBA), firms that maintain a formal operating budget have a 70% higher chance of staying in business for five years compared to those that do not.

- Another critical aspect is the cash flow forecast, which projects the cash that will flow in and out of the business over a designated timeframe. This tool helps business owners ascertain their liquidity position, ensuring they have enough cash to cover unpaid expenses, invest in growth opportunities, and manage debt obligations. Small businesses with a positive cash flow forecast tend to experience 20% more growth, allowing them to seize opportunities as they arise.

Variance Analysis

Variance analysis is a vital component of financial control, comparing the budgeted figures to actual performance. By assessing these variances, businesses can identify discrepancies, understand the reasons behind them, and implement corrective actions. For instance, a company that forecasts $100,000 in revenue but only generates $80,000 must investigate the

causes of this $20,000 shortfall. Are there market changes affecting sales, or is it an issue with the product’s attractiveness?

Additionally, variance analysis can support strategic planning efforts. By continually analyzing variances, businesses can adjust their strategies to better align with performance trends, optimizing their financial trajectory.

Importance of Budgeting and Forecasting

For small business owners, having a robust budgeting process can streamline operations and significantly aid in decision-making. Knowing where money is allocated and anticipated revenue allows for more strategic spending and investment decisions. Moreover, according to a study by the Harvard Business Review, companies that actively engage in financial forecasting report 8% higher revenue growth than those that do not utilize such practices.

However, it's important to acknowledge the potential pitfalls of budgeting and forecasting. Rigid adherence to a budget can hamper flexibility and responsiveness to new opportunities or emerging threats. Economic downturns, market trends, or internal company changes can all render a once-accurate forecast moot. Additionally, overestimating revenues can lead to financial strain, as 61% of small businesses report struggling with cash flow at some point, exacerbating the risks associated with aggressive budgeting.

Ultimately, effective budgeting and forecasting provide the framework for informed decision- making, enhancing the potential for achieving long-term business success. Striving for a balance between structured financial planning and the flexibility to pivot as needed can empower small business owners to navigate uncertain financial landscapes with confidence.

What are Current Trends Saying!

→ Current trends in budgeting and financial forecasting for small businesses are evolving rapidly, particularly due to technological advancements and shifts in consumer demands. A significant trend is the increasing reliance on sophisticated budgeting software that automates and streamlines financial management tasks. According to a recent survey conducted by Finances Online, around 70% of small businesses have adopted some form of budgeting software, citing improved accuracy and time efficiency as the primary benefits. This high adoption rate illustrates a shift from traditional manual methods to more automated solutions.

→ Accompanying this trend is the rise of AI-assisted forecasting tools. These technologies utilize machine learning algorithms to analyze historical data and make predictions about future financial trends. A report by Deloitte noted that small businesses utilizing AI for forecasting have experienced a 25% increase in forecasting accuracy compared to those relying on conventional methods. This leap in predictive capabilities has led many industry experts to suggest that AI will become a standard component of financial management, especially for businesses looking to scale.

→ Mobile financial management apps are another critical facet of modern budgeting practices. Data from Statista indicates that over 50% of small business owners now prefer managing their finances on mobile platforms due to the convenience and accessibility these tools provide. However, while mobile apps can increase efficiency, they also raise concerns about security and data privacy. Experts warn that as more financial data is stored in the cloud and accessed via mobile devices, the risks of cyber threats escalate significantly.

Debate about the effectiveness of these technological tools versus traditional budgeting methods.

In addition, there is an ongoing debate about the effectiveness of these technological tools versus traditional budgeting methods. Proponents of advanced technologies argue that automation leads to greater efficiency and better financial insights. However, some small business owners express skepticism, fearing that reliance on technology may overlook the nuances of their unique business contexts. According to a survey by the National Small Business Association, around 40% of small business owners still prefer conventional budgeting processes, believing that personal insight and experience are irreplaceable in financial decision-making.

Furthermore, the integration of these technologies poses another challenge: adaptability and training. A report from McKinsey reveals that nearly 60% of small businesses struggle to fully utilize their financial tools due to a lack of skills or training. As a result, the landscape of budgeting and forecasting remains a dichotomy between the modernized approach and the traditional wisdom, compelling businesses to find a balance that works for their specific circumstances.

Overall, the landscape of budgeting and financial forecasting for small businesses is witnessing profound changes driven by technology. While the advantages of automation and AI in enhancing accuracy and efficiency cannot be overlooked, business owners must also be mindful of the limitations and challenges that come with these innovations. The conversation around budgeting continues to evolve, reflecting diverse perspectives on how best to navigate an increasingly complex financial environment.

Practical Applications

Effective budgeting and financial forecasting can transform a business's approach to management, especially in today's fast-paced economic environment. For example, the case of Baker's Dozen, a small bakery in Minneapolis, highlights the role of budgeting in understanding cash flow. Initially, the bakery faced seasonal sales fluctuations, leading to cash shortages during off-peak months. By implementing a detailed budget that categorized seasonal expenses and projected monthly earnings, they managed to smooth cash flow and even identified opportunities for promotional offers during slower months. As a result, they reported a 20% increase in revenue during the off-peak seasons.

Moreover, let's consider TechX Solutions, a small tech consulting firm that turned to financial forecasting to better allocate its resources. They utilized historical data to create forecasts, identifying peak times for project work. This led them to hire temporary staff during high- demand periods, which significantly improved their ability to take on additional clients without overextending their existing workforce. As a result, their profitability jumped by 30% in just one year.

While the positive impacts of budgeting and forecasting are evident, it is essential to acknowledge some challenges. Many small business owners report feeling overwhelmed by the complexity of creating accurate financial models. According to a study by NerdWallet, about 60% of small business owners do not feel confident in their financial planning abilities. This uncertainty can lead to underestimating expenses or overestimating future revenues, resulting in poorer decision-making.

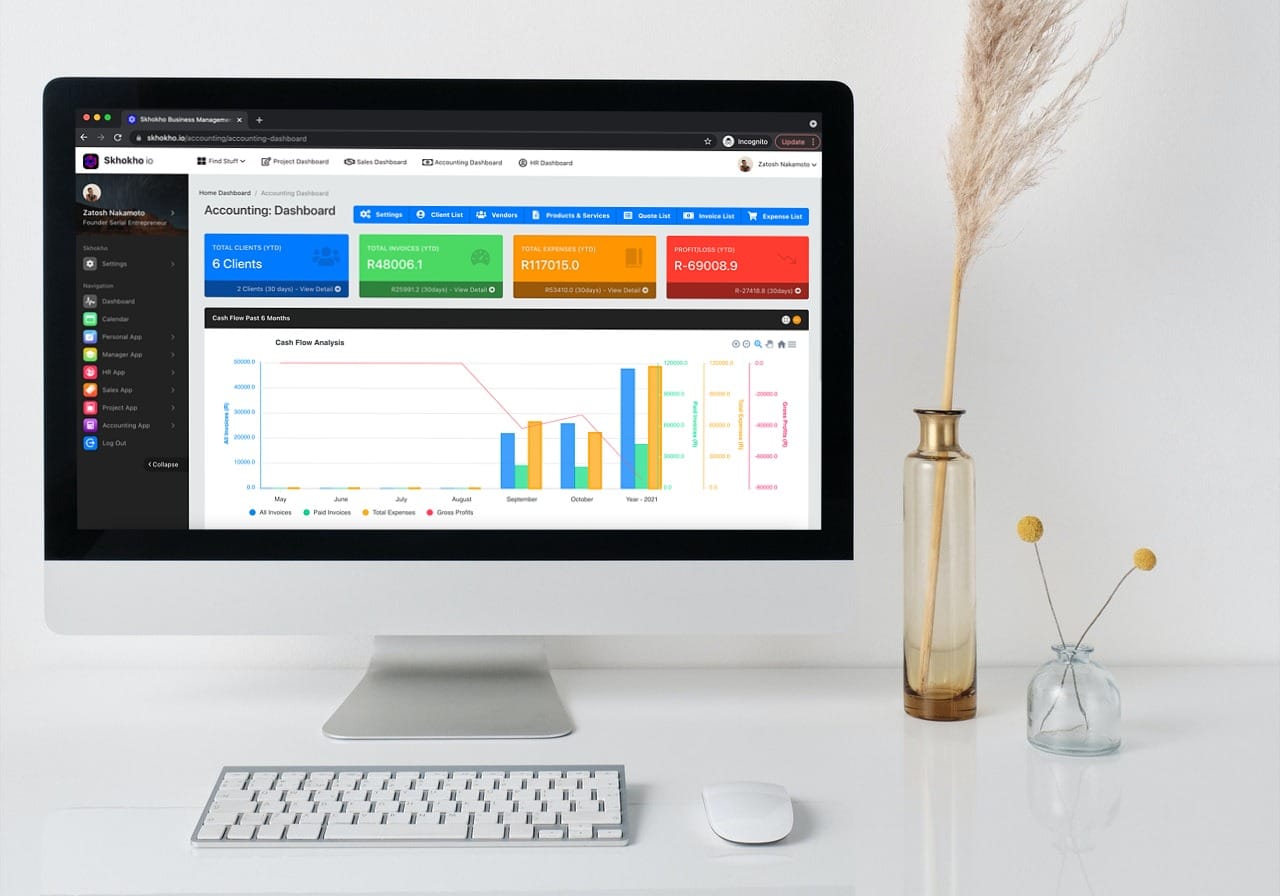

However, tools like Skhokho Business Management Software and other budgeting software have made financial forecasting more accessible. Testimonials from users of these platforms show significant improvements in their financial outcomes. This Business suite has an Accounting App dedicated to helping small businesses to manage their finances nicely. To read more about this, click here: Financial Management for Small Businesses

Challenges

Small businesses encounter numerous challenges in budgeting and financial forecasting that can significantly impact their growth and sustainability.

Challenge1: Financial Literacy. One critical barrier is financial literacy. A study conducted by the National Financial Educators Council revealed that 60% of small business owners lack even basic financial literacy, which hampers their ability to effectively manage budgets and forecast future revenues. This deficiency can lead to miscalculations, poor investment decisions, and ultimately, business failure.

Challenge 2: Variability of market conditions: Another substantial challenge is the variability of market conditions. Small businesses often operate with limited resources, making them more vulnerable to economic fluctuations. According to a report by the Small Business Administration, 30% of small businesses fail due to insufficient cash flow. This statistic highlights the importance of accurate financial forecasting which, when disrupted by unexpected market changes, can lead to significant revenue shortfalls.

Challenge 3: Resistance to adopting new financial technologies further complicates the landscape for small businesses. Embracing tools like budgeting software and financial analytics can streamline financial processes, yet many business owners remain hesitant. A survey by QuickBooks found that 49% of small business owners cite the complexity and perceived cost of new technologies as their main reasons for reluctance. This hesitation not only limits the potential for efficiency but can also result in outdated financial practices that do not adequately respond to dynamic market environments.

The anecdote of a small bakery illustrates these points vividly. After experiencing a peak season, the owner, without a proper budgeting process, overestimated future demand and overstocked ingredients. When the anticipated customer rush didn't materialize, the business was left with significant waste, ultimately impacting profitability. This situation underscores how insufficient understanding of financial forecasting can lead to tangible losses.

Statistics indicate that when small businesses employ robust financial management practices, they can see a growth rate up to 8% higher than their less financially savvy counterparts. However, this advantage is often lost due to internal challenges—only 32% of small business owners frequently review their financial statements. This infrequency highlights a disconnect that often leads to missed opportunities for expansion and informed decision-making.

Solutions

Investing in financial education is one of the most powerful strategies small businesses can implement to overcome financial challenges. According to a study conducted by the National Endowment for Financial Education, 70% of Americans lack basic financial literacy skills. By prioritizing ongoing education, small business owners can make informed decisions regarding budgeting, investing, and managing debt. Business owners can attend workshops, participate in online courses, or leverage resources from financial institutions to enhance their knowledge.

In today’s digital age, embracing technology for automation can streamline financial processes and reduce manual errors. A survey by QuickBooks found that 67% of small business owners who used automation reported saving time, which allows them to focus on their core operations. Implementing accounting software can automate invoicing and financial reporting, thereby improving accuracy and efficiency. Tools like Xero and FreshBooks provide user-friendly interfaces for tracking expenses and managing cash flow, which are indispensable for maintaining financial health.

Regularly reviewing financial goals is critical for small businesses to stay on track. Studies show that businesses with clearly defined goals can achieve growth rates 3.5 times faster than those without. Setting quarterly reviews allows entrepreneurs to assess their progress, adjust strategies, and realign efforts with their financial aspirations. Creating a financial calendar that includes these checkpoints can help in maintaining discipline in tracking income, expenses, and profitability ratios.

Engaging financial consultants can also provide invaluable expertise that small business owners may lack. According to a survey by the Association of Financial Professionals, 73% of small businesses that worked with financial advisors reported improved financial performance. Financial consultants can offer insights into investment strategies, tax optimization, and risk management, empowering owners to navigate complex financial landscapes. Choosing a consultant with a background in small business finance is crucial; a one-size-fits-all approach may not yield the desired results.

Furthermore, creating community partnerships can enhance financial literacy and bolster support networks. Many local chambers of commerce and non-profit organizations offer free resources, workshops, and mentorship programs to help small businesses thrive. Statistics from the Small Business Administration indicate that companies that actively engage with their community have 63% higher revenue growth compared to those that do not. By collaborating, small businesses can share experiences, access shared resources, and improve their collective financial acumen.

Lastly, implementing peer-to-peer learning can prove beneficial for small business owners. Establishing or joining mastermind groups where entrepreneurs meet regularly to discuss financial challenges and solutions can provide different perspectives. In a recent poll, businesses that participated in such groups reported a 15.7% increase in overall profit margins. Peer support not only fosters accountability but also encourages innovative problem-solving by sharing diverse experiences and strategies.

Future Outlook

The future of budgeting and financial forecasting in small businesses is set to evolve dramatically amid shifts in the economic landscape, such as the burgeoning online commerce sector and the gig economy. As digital sales grow—projected to reach 24% of total global retail by 2026—small businesses must recalibrate their financial strategies to account for new costs like digital marketing and enhanced cybersecurity. Additionally, the gig economy, which infused $1.2 trillion into the U.S. economy in 2021, demands flexible budgeting to manage less predictable costs from freelance work. These changes underscore the need for advanced financial tools that offer real-time tracking and predictive analytics to navigate these complex, dynamic environments effectively.

Final Thoughts

Reflecting on the shifting financial management needs, it's clear that thriving in the future requires more than just reactive measures—it demands proactive financial planning and execution. While many small businesses still rely on basic tools like Excel for budgeting, the complexities of today's economy call for more sophisticated solutions like cloud-based financial systems like Skhokho Accounting App.

Regular financial reviews and embracing advanced forecasting models are essential steps towards aligning with market dynamics and ensuring business resilience. In essence, the path to sustained growth and success lies in a proactive approach to financial health, ensuring businesses are well-prepared for the economic changes ahead. Click here to register and use up your 14 day free trial: https://skhokho.io/authentication/register