Financial Management for Small Businesses: A Skhokho Toolkit

Efficient financial management is the bedrock of success. The ability to budget, invoice, and track expenses seamlessly can mean the difference between thriving and struggling. Enter Skhokho, the comprehensive toolkit designed to empower small businesses with powerful financial management tools that streamline operations and drive growth. In this blog, we will explore how Skhokho's financial management tools can revolutionize your small business, ensuring that your financial house is in order and poised for prosperity.

By utilizing Skhokho's financial management tools, small businesses can unlock the potential of efficient budgeting, ensuring financial stability and resilience in an ever-changing business landscape.

In this blog we discuss the following:

- Why Does A Small Business Need Financial Management

- Budgeting Made Simple

- Effortless Invoicing

- Streamlined Expense Tracking

- SAGE Integration

- Enhanced Cash Flow Management

- Comprehensive Financial Reporting

Why Does A Small Business Need Financial Management

Financial management is the lifeblood of any business, and for small businesses, it is absolutely indispensable. While the scale of operations may differ, the principles of sound financial management remain universal and crucial. Small businesses often operate with limited resources, making it essential to have a clear and detailed understanding of their financial standing.

Financial management is the compass that guides small businesses toward financial stability and success. It empowers them to maintain control over their finances, make strategic decisions, ensure compliance, and allocate resources efficiently. Skhokho's financial management toolkit is designed to address the unique needs of small businesses, providing them with the tools and insights required to navigate the complex world of finance with confidence and clarity.

Here are some compelling reasons why small businesses need effective financial management:

Financial Control and Clarity

Financial management tools, like those offered by Skhokho, provide small businesses with the ability to maintain precise control over their finances. This includes tracking income and expenses, monitoring cash flow, and creating budgets. With financial clarity, small businesses can make informed decisions that enhance profitability and ensure long-term sustainability.

Strategic Decision-Making

Effective financial management equips small businesses with the data and insights needed to make strategic decisions. Whether it's expanding operations, investing in new technology, or hiring additional staff, financial management tools allow small business owners to assess the financial feasibility of these initiatives. Skhokho's toolkit goes a step further by offering comprehensive financial reporting and analytics, enabling small businesses to analyze trends and key performance indicators, thus fostering informed and strategic decision-making.

Compliance and Accountability

Financial management is not just about boosting profits; it's also about compliance and accountability. Small businesses are subject to financial regulations and tax obligations. Skhokho's financial management tools can assist in staying compliant by providing tools for accurate record-keeping and reporting. This not only ensures that the business adheres to legal requirements but also establishes a sense of accountability within the organization.

Improved Resource Allocation

Small businesses often have limited resources, and optimizing their use is essential. Effective financial management allows for better resource allocation. By understanding which areas of the business generate the most revenue and which ones incur the most expenses, small businesses can make data-driven decisions about where to invest and where to cut costs.

Budgeting Made Simple

Effective budgeting is the cornerstone of financial success. Small businesses often juggle numerous responsibilities, from monitoring revenue and tracking expenses to managing cash flow and ensuring profitability. This is where Skhokho steps in, offering a comprehensive toolkit that transforms budgeting into a simplified and strategic process.

Skhokho's financial management tools make budgeting a straightforward endeavor for small businesses. The platform provides an intuitive interface that allows you to create, monitor, and manage budgets seamlessly. With a clear view of your revenue streams and expenses, you can make informed decisions and allocate resources efficiently. Skhokho's budgeting capabilities empower you to set realistic financial goals, track your progress, and adapt your strategies as needed to achieve sustainable growth.

What sets Skhokho apart is its integrated approach to budgeting. Small businesses can harness the platform's unified tools to streamline budget creation and management, irrespective of the team members' locations. This cohesive solution not only simplifies the budgeting process but also ensures that everyone is on the same page, promoting financial transparency and accountability within your organization. By leveraging Skhokho's financial management tools, small businesses can transform budgeting from a complex chore into a strategic advantage, helping them navigate financial challenges with confidence and align their financial strategies with their broader business goals.

Effortless Invoicing

Timely and accurate invoicing ensures that your hard-earned revenue is received promptly. Skhokho's financial management tools introduce a new era of effortless invoicing for small businesses. With Skhokho, generating professional invoices, custom-tailored to reflect your brand, becomes a straightforward process. Whether you're invoicing for products or services, Skhokho's features empower you to create, send, and track invoices with ease.

Skhokho's invoicing capabilities extend beyond the basics. The platform provides a comprehensive view of payment status, allowing you to monitor outstanding invoices in real-time. This real-time visibility into your financial transactions ensures that your cash flow remains healthy, helping you stay on top of your financial obligations. By simplifying the invoicing process and offering robust tracking features, Skhokho's business software tools enable small businesses to spend less time on administrative tasks and more time focusing on growth and innovation.

Skhokho also offers the flexibility to adapt your invoicing methods to suit your unique business needs. Whether you require recurring invoices, automatic payment reminders, or the ability to accept multiple payment methods, Skhokho's invoicing features are designed to accommodate your preferences. By utilizing Skhokho's financial management tools, small businesses can elevate their invoicing process, ensuring that revenue flows smoothly and financial operations remain well-organized.

Streamlined Expense Tracking

For small businesses, keeping a close eye on expenses is essential for financial health and sustainability. Skhokho's financial management toolkit offers a streamlined solution for tracking expenses efficiently. With Skhokho, small businesses can easily record and categorize expenses, eliminating the need for manual and time-consuming processes. This automation not only saves valuable time but also ensures that all financial data is accurately recorded.

![]()

Skhokho's expense tracking features provide real-time visibility into where your financial resources are allocated. By maintaining an up-to-date record of expenditures, you gain valuable insights into cost structures and patterns. This data-driven approach empowers you to identify opportunities for cost optimization, make informed financial decisions, and ensure that your spending aligns with your business goals.

Skhokho's financial management tools also offer the convenience of on-the-go expense tracking. Team members can input expenses from anywhere, whether they're in the office or working remotely. This accessibility ensures that expenses are recorded promptly, reducing the risk of oversights and inaccuracies. Small businesses can rely on Skhokho to simplify expense tracking, helping them maintain financial discipline and allocate resources strategically.

![]()

SAGE Integration

Skhokho offers seamless integration with SAGE Cloud Accounting software, enhancing the synergy between your Skhokho Application and SAGE Cloud Accounting. This integrated solution facilitates a bi-directional data flow, enabling the seamless exchange of critical information. This encompasses essential data points such as Customers (Skhokho Clients), Tax Invoices (Skhokho Invoices), Quotes, and Items (Skhokho Products and Services). In practical terms, this means that all records present in SAGE Cloud Accounting effortlessly synchronize with Skhokho, and vice versa. This synchronized integration not only streamlines data management but also ensures data consistency and accuracy across both platforms, bolstering the efficiency of your small business's financial operations."

The integration extends its benefits by eliminating data redundancy and the need for manual data entry. By bridging Skhokho and SAGE Cloud Accounting, this integrated solution enhances your small business's financial capabilities, empowering you with the tools to manage financial data effortlessly and make informed decisions. In essence, it simplifies and elevates financial management, allowing you to focus on what truly matters – growing your small business.

Enhanced Cash Flow Management

Cash flow management is a critical aspect of financial success for small businesses. Skhokho's financial management toolkit offers enhanced cash flow management capabilities that empower small businesses to maintain financial stability and resilience. With Skhokho, you can gain a clear view of your cash position, anticipate potential cash flow gaps, and take proactive measures to ensure a smooth financial operation.

Skhokho's cash flow forecasting and monitoring features provide real-time insights into your incoming and outgoing cash. This visibility enables you to make informed decisions about spending and investment, helping you steer your small business toward sustainable growth. By staying ahead of cash flow challenges, you can confidently navigate financial ups and downs and ensure that your business remains financially resilient.

Skhokho's integrated approach ensures that cash flow management becomes an integral part of your financial strategy. With seamless access to your financial data, you can monitor cash flow trends, identify areas for improvement, and make data-driven decisions to optimize your small business's financial health. Skhokho's financial management tools empower small businesses to harness the power of enhanced cash flow management, setting the stage for financial success and growth.

Comprehensive Financial Reporting

Small businesses thrive on data-driven decisions, and comprehensive financial reporting is the compass that guides these decisions. Skhokho's financial management toolkit includes robust features for generating detailed and insightful financial reports, empowering small businesses to gain a holistic view of their financial health.

Skhokho's reporting capabilities encompass a wide range of financial metrics and key performance indicators (KPIs). These reports provide small businesses with the essential data points needed to assess their financial well-being, track trends, and make informed strategic decisions. Whether it's analyzing revenue trends, expense patterns, or cash flow projections, Skhokho's financial reports offer a comprehensive and granular view of your financial landscape.

Skhokho's financial reporting tools facilitate the customization of reports to align with your specific business needs. You can tailor reports to focus on the metrics that matter most to your small business, ensuring that you have the insights required to drive growth and make agile financial decisions. By harnessing the power of comprehensive financial reporting, small businesses can navigate the complexities of financial management with clarity, confidence, and a strategic edge.

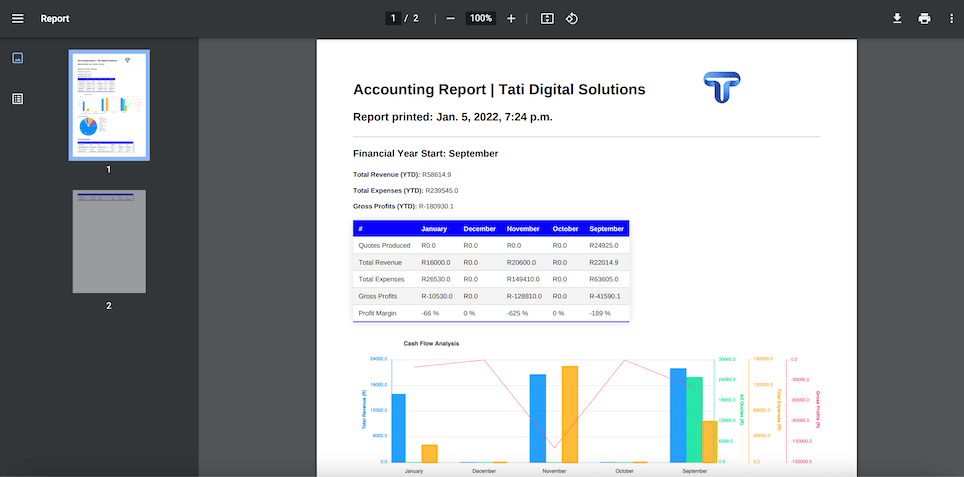

Here is an illustrative demonstration of how the Skhokho Accounting App generates and outputs PDF versions of financial statements.

Skhokho's financial management toolkit equips small businesses with the means to generate comprehensive financial reports that provide actionable insights. With Skhokho, small businesses can make data-driven decisions, monitor financial health, and adapt their strategies to ensure long-term success. Explore the possibilities of Skhokho's financial management tools and unlock the full potential of your small business's financial management today.

Where To From Here

Sign up with Skhokho today for a free trial.

Skhokho's financial management toolkit equips small businesses with the tools they need to navigate the financial complexities of entrepreneurship. Whether you need to create budgets, streamline invoicing, or track expenses, Skhokho offers a comprehensive solution that empowers you to make informed financial decisions and drive your small business toward sustained growth and success. Explore the possibilities of Skhokho's financial management tools and unlock the full potential of your small business today.

With clear insights into your revenue and expenses, you can make informed decisions and allocate resources efficiently. Skhokho's budgeting capabilities help you set realistic financial goals, stay on top of your financial health, and adjust your strategies as needed to achieve sustainable growth. Skhokho's financial toolkit includes robust invoicing features that allow you to generate professional invoices, customize them to reflect your brand, and send them to clients with ease. Tracking payments and monitoring outstanding invoices becomes a breeze, enabling you to maintain healthy cash flow. With Skhokho, you can spend less time on administrative tasks and more time focusing on what truly matters—growing your business.

Skhokho's financial management tools include expense tracking features that enable you to record and categorize expenses efficiently. By maintaining a real-time record of your expenditures, you gain valuable insights into where your money is going. This data-driven approach helps you identify areas where cost-cutting is possible and ensures that your financial decisions are aligned with your business goals. Skhokho's toolkit offers cash flow forecasting and monitoring features that provide a clear view of your cash position. This allows you to anticipate potential cash flow gaps and take proactive measures to ensure a smooth financial operation. By staying ahead of cash flow challenges, you can navigate financial ups and downs with confidence and maintain financial stability.

Sound financial management relies on having access to accurate and actionable insights. Skhokho's financial toolkit offers comprehensive reporting and analytics features, enabling you to generate detailed financial reports that provide a holistic view of your business's financial health. These reports offer essential data points, allowing you to track key performance indicators, identify trends, and make data-driven decisions to guide your small business toward success.

Here are more interesting blogs to read.

Billing and Invoicing Software for Small Businesses, Cash Flow Management Basics for Small Businesses, The Role of Business Management Software in Financial Planning and Reporting.