How to use CRM software to forecast future cash flow projections

A CRM (customer relationship management) system is a valuable tool for businesses of all sizes. It can help you keep track of your customers' contact information, past purchases, and other interactions. This information can be used to create customer profiles, which can then be used to forecast future sales and cash flow trends.

In a previous blog we discussed how to utilise cash flow forecasting to better understand your business financial standing. The three types of cash flow forecasting discussed: (1) trend forecasting, (2) causal forecasting and (3) judgement forecasting.

In this blog we will expand on utilising CRM software to specifically get better cash flow forecasting via both trend and causal forecasting.

To use a CRM to forecast future sales trends, you'll need to create a customer profile for each of your customers. This will include information such as:

-Contact information

-Company/client size, location

-Interactions with your company

Combining this information with: (1) previous purchase history via invoices or sales records, (2) requests for quotations information and other metrics obtained from your accounting software can lead to a treasure of data that can reliably start to create room for accurate future cash flow projections.

In addition, this data can help your marketing teams focus efforts in the right direction by investing in campaigns that produce higher value clients, as opposed to campaigns that do not produce higher value clients.

For example if you spend the same amount of budget on Facebook and Twitter ads, and they both provide you with the same amount of traffic and sign-ups, and your use your CRM software to determine the source of your clients.

Over time, as the clients purchase from your business, you might notice the twitter clients buy smaller items of lower value, compared to the clients acquired from Facebook who purchase larger items of higher value. You will calculate the the client value of that Facebook client is higher than the client value of the Twitter Client. This information can only be observed after a period of time analysing sales records from your accounting software, integrated with the sales software and client profile. In this case, the marketing team can conclude that, the overall returns would be better if the company spends more on the Facebook ads budget. What initially appeared to be equal traffic, computes to a different client value.

In essence, a company can increase the marketing budget return on investment (ROI) by analysing CRM data, combined with accounting data. Read more here: How to find and retain high value clients.

Tips for staying on top of your cash flow projections

- Make sure you have a good understanding of your company's historical sales and revenue trends. This will give you a good baseline to work from when forecasting future trends.

- Use CRM software to help you track your sales pipeline and forecast future sales. This will help you to better predict future cash flow trends.

- Stay on top of your company's expenses and make sure you have a good understanding of your projected expenses for the future. This will help you to stay within your budget and avoid any cash flow problems.

- Keep a close eye on your company's receivables and make sure you have a good understanding of your projected accounts receivable. This will help you to ensure that you're not overextended financially.

- Plan ahead and stay proactive. By planning ahead and forecasting future cash flow trends, you'll be better prepared to handle any financial challenges that may come your way.

Using Skhokho CRM and Accounting Software for better Cash Flow Projections

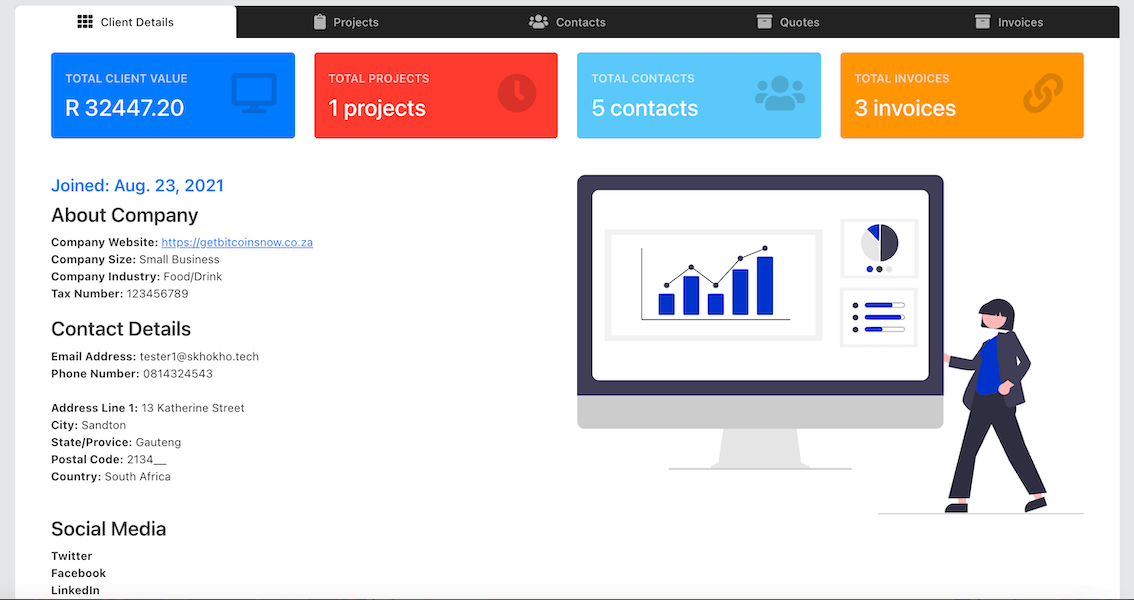

Create Client Profile

The first step is to create a client profile. There are two ways of creating a client profile on Skhokho: (1) Within the project management app as a project manager and (2) within the accounting app as the accounting manager or team.

There is a reason that Sales departments do not get to create and update client information - their involvement ends when they convert a lead, however within their requirement to continue cultivating the client relationship, they often have to work hand-in-hand with project managers. Therefore, Skhokho provides access to client information to the sales team, from within the sales app.

Sales teams can:

- View the list of active clients

- See the client profile information, quotes, contacts and revenue via invoices

- Maintain relationships with the clients

Create a Future Cash Flow Estimation

Future cash flow can be made up of the following sources:

- Recurring income from existing contracts (can be estimated from the recurring invoices)

- Estimated revenue from existing clients (can be estimated from the client profile page, based on the contract value or current trends)

- Expected revenue from trends analysis (can be estimated from current and historical invoices)

- Expected potential revenue from current leads (estimated from the opportunty value and lead conversion rates)

Track and Measure Projections versus Actuals

As an additional tip, you can start creating Objective Key Results (OKRs) for your cash flow. Once you start measuring a value, you can create goals and targets around it and work on improving it for your business.

For example lets us say to estimate R1.2million for the next three months, but know you will need more. You can create an OKR for this target, and call it “Improve cash flow by 30%” for example. Then start creating Key Results, actions and a plan to achieve it. It could be increasing marketing spend, focusing on high value clients or anything that will generate those results.

Measuring a variable is just the first step in a journey to growth and Skhokho has all the tools to measure, monitor, report on and even start proactively improving on key business metrics.

Benefits of accurate cash flow forecasts for your business

Forecasting business cash flow can provide a number of benefits for companies. Perhaps the most obvious benefit is that it can help a company determine how much cash it will have available in the future.

This can be helpful for budgeting and making strategic decisions about where to allocate resources. Forecasting can also help a company identify potential problems with its cash flow and take steps to address them before they become too serious.

In addition, forecasting can be used to track progress and assess the effectiveness of various business strategies. Overall, forecasting can be a valuable tool for businesses of all sizes.

Get Started with Skhokho

Register: https://skhokho.io/authentication/register

Read Documentation: https://skhokho.io/documentation/guide/

Watch Youtube Videos: https://www.youtube.com/channel/UCEUBXG1R5YzUmuvGaJP9KYA