Utilize cash flow forecasting to better understand your business's financial standing

In this blog we will be discussing the exciting topic of “cash flow forecasting” for your small business. We will discuss what it is, and what are the benefits of creating realistic cash flow forecasts and how they can help you better understand the financial standing of your business.

We will also discuss practical ways that you can start building your cash flow forecast, with real data based on your current business operations.

Introduction

Cash flow forecasting is a key tool for understanding your business's financial standing. By creating a cash flow forecast, you can track your incoming and outgoing cash flow, and identify any potential problems or opportunities. This information can help you make informed decisions about your business's future.

There are a number of different methods for creating a cash flow forecast. The most important thing is to use the method that is most relevant to your business.

The most common methods are:

-Cash flow from operations: This method looks at your business's cash flow from its normal operations. It includes revenue and expenses, as well as changes in working capital.

-Cash flow from investments: This method looks at your business's cash flow from its investments, such as loans, investments, and accounts receivable.

-Cash flow from financing: This method looks at your business's cash flow from its financing activities, such as issuing stock, issuing debt, and making payments on debt.

Once you have created a cash flow forecast, you can use it to make informed decisions about your business. You can use it to:

-Monitor your business's financial health

-Make decisions about whether to expand or contract your business

-Make decisions about whether to borrow money or invest money

-Make decisions about how to price your products and services

-Make decisions about when to pay bills and when to collect payments

-Plan for future expenses and revenue

In this blog we will focus on the first method, cash flow from operations. We will discuss how to use Skhokho accounting and sales CRM app to create a realistic and data backed cash flow forecast.

The Importance of Forecasting

There are a few key reasons why forecasting is important:

-It can help you identify areas of your business where you are losing money or could be making more money.

-It can help you make better decisions about where to allocate your resources.

-It can help you plan for future expenses and revenue.

-It can help you identify and avoid financial trouble.

Forecasting is not an exact science, and there are always variables that can't be predicted. However, by using historical data and trend analysis, you can get a good idea of what to expect in the future.

Types of Forecasting

Forecasting is the process of estimating future events or trends.

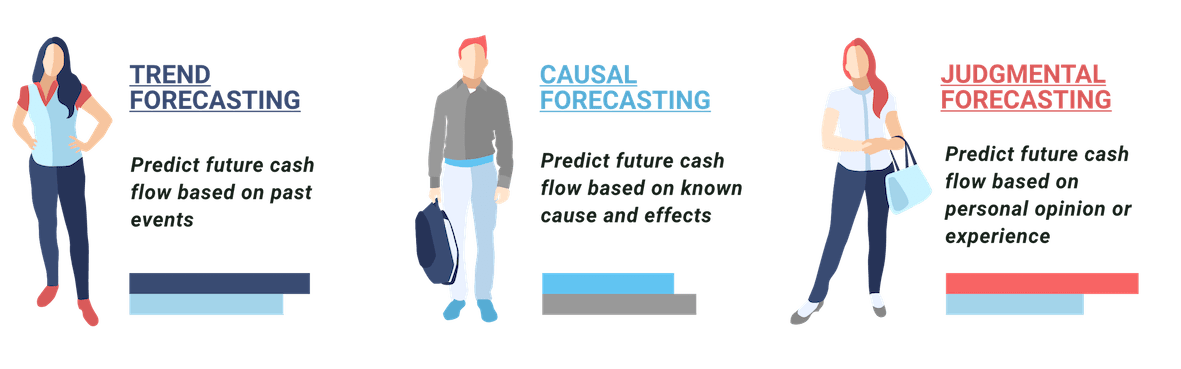

There are three main types of forecasting: (1) trend forecasting, (2) causal forecasting, and (3) judgmental forecasting.

Trend forecasting is the process of predicting future events based on past trends. This type of forecasting is often used for consumer goods, such as fashion and food. Trend forecasting can be done using historical data, surveys, and consumer research.

Causal forecasting is the process of predicting future events based on known causes and effects. This type of forecasting is often used for business decisions, such as production planning and inventory management. Causal forecasting can be done using statistical models and historical data.

Judgmental forecasting is the process of predicting future events based on personal opinion or experience. This type of forecasting is often used for business decisions, such as pricing and marketing. Judgmental forecasting can be done using personal experience, expert opinion, and market research.

Forecasting is an important tool for businesses to use in order to make informed decisions. The type of forecasting used will depend on the type of business and the type of data available. Forecasting can help businesses understand their financial standing, make better decisions, and plan for the future.

Utilising Skhokho Business Software to develop reliable data backed cash flow forecasts

In order to develop reliable and data-backed cashflow as a business, a combination of causal and trend forecasting is required.

Trend forecasting is required - because the business past performance is the best indicator of future potential. Financial institutions, banks, lenders and investors all use trend forecasting to determine the future valuation and calculate risk in order to estimate potential cash flow for a business.

You can use the same methods to determine your own cash flow projections.

An example is a business that has constantly made $100k MRR (monthly recurring revenue) for the last 6 months. It would be safe to project and assume that the business will continue to make the same revenue going in to the future, provided all things remain equal

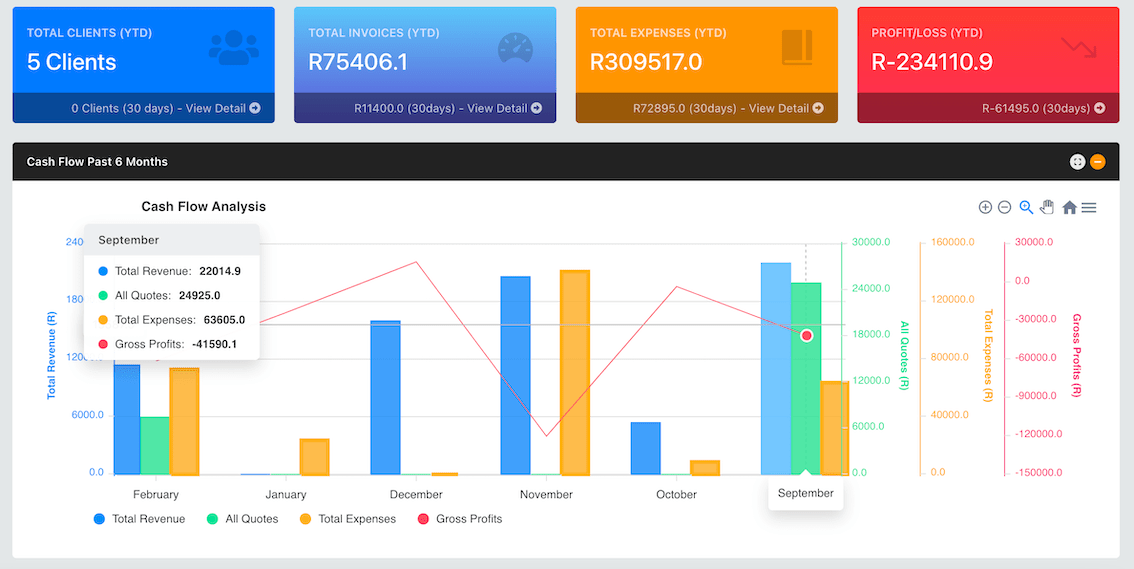

The image above illustrates a cash flow diagram from operations, by simply extending this forward, you can create your future projections based on historical values. It is crucial to mention at this point, that actually recording accurately your current cash flow is required to make success of this method.

This means, accurately recording:

- All of your invoices (and the status - paid, outstanding etc)

- All of your business expenses

All of this is functionality that Skhokho can help you with - read more on the Accounting Software Documentation page.

Cash flow predictions from issued quotes - Causal Cash Flow Forecasting

Another method to produce reliable, data based cash flow forecasts is by analysing your current “quotes” data. This depends on your type of business of course, but assuming that you generally provide quotes to businesses, analysing the current quotes and rate of acceptance can give you a crystal ball view in to your future finances.

However this method, might still have limitations as quotes generally have a quick turn-around time, they are as good as trend forecasting. A more causal approach would be to analyse your sales funnels and sales efforts.

Cash flow predictions from sales funnel - Causal Cash Flow Forecasting

Every business requires a sales or business development department in one form or another, some may call it marketing. This is the department that is forward looking and spending money on generating new business for the company. Sales efforts can involve both marketing and or lead generation.

When you start to analyse the success of your sales efforts (lead conversion rates) and actual value of leads in your sales pipelines, you can start to develop fairly accurate financial projections that can look ahead months or even years in to the future.

Ultimately analysing sales data is the best tool for future cash flow projections on any business.

You can break down the data you need in to:

Success rates, conversion rates of leads - how many leads (percentage) do you generally convert (this can be trend data)

Lead Confidence - when you chase leads, you have differing levels of confidence. You might feel more confident in winning a lead with a known client with an established relationship, than a new client.

Estimated value of all leads - what is the estimated monetary value of your sales leads.

Cash flow projection = Value of lead X Probability to win lead

Where:

Probability of winning the lead is = (Lead confidence + Lead conversion)

Skhokho CRM to generate the data

Use Skhokho CRM (Sales and Business Development Software) to generate the data that you need to start making accurate calculations on financial projections.

Read more here: https://skhokho.io/documentation/sales/

14 Day Free Trial: https://skhokho.io/authentication/register