What are the most important factors investors look for when evaluating a startup?

In this blog we will be discussing the most important factors investors look for when evaluating a startup? Are you a startup founder looking for investors? Or are you getting ready for an investor pitch and want to make sure you have all your ducks in a row?

This blog will present a cheat-sheet, to get you ready for your investor encounter, and help prepare you put your best foot forward and demonstrate clearly to investors your business idea and potential.

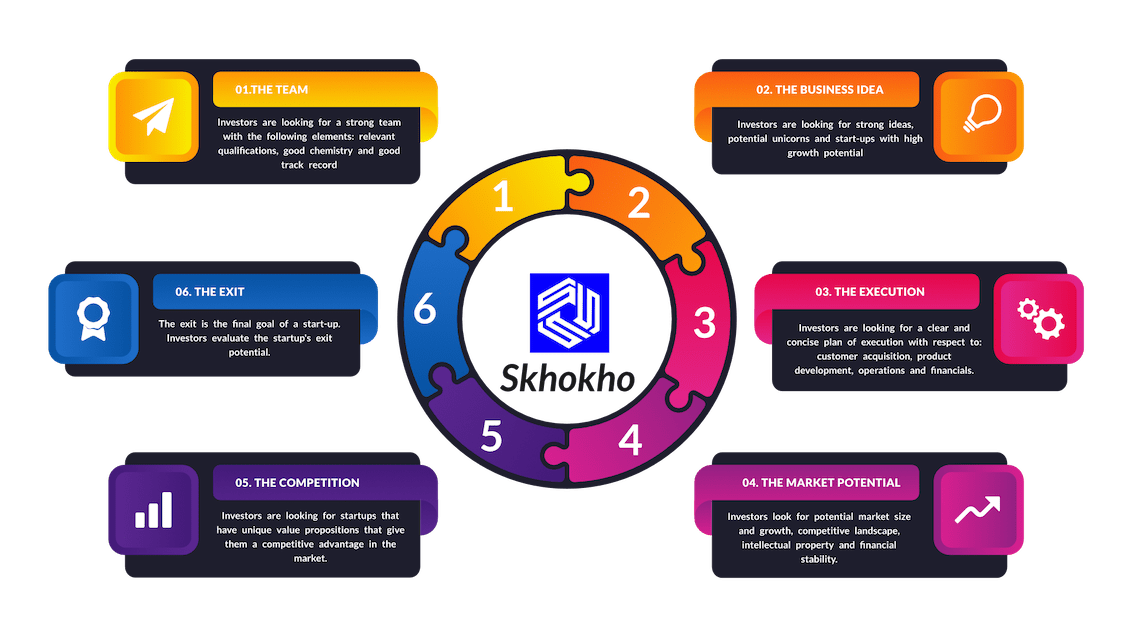

After reading this blog, you should be able to understand:

- What processes investors follow when investigating a startup for investment

- The most important factors you must consider when preparing to meet with an investor

- How investors evaluate startup businesses

- How to best position your business for investment

The Startup Evaluation Process

The evaluation process for startup companies is important for a variety of reasons. Firstly, it helps to ensure that the company is making progress and that the investment is worth making. Secondly, it allows investors and venture capitalists to judge the potential of the company, and to decide if they should invest further. Lastly, the evaluation process helps to identify any weaknesses in the startup, so that they can be fixed as quickly as possible.

There are a number of different ways in which a startup can be evaluated. The most common approach is to carry out a 'hands-on' evaluation, which means visiting the company and investigating its operations firsthand. This is usually the least expensive way to do an evaluation, and allows the most information to be obtained. However, it can be difficult to carry out an evaluation if the company is not located near to where the evaluator is located.

Another approach is to carry out a 'remote' evaluation. This means reviewing the company's information, and making a judgement based on this. However, this can be more difficult, as it is difficult to get a sense of the company's culture and environment.

A third approach is to carry out an evaluation using a 'model' or 'benchmarking' approach. This involves looking at other companies - either ones that are similar to the startup, or ones that are different - and making a judgement based on this.

After an evaluation has been carried out, the results will usually be compiled and presented to the company, its investors, and the relevant members of the M&A (mergers and acquisitions) community. This will allow them to make a judgement about the potential of the startup, and to decide if they want to invest further.

The Team

When evaluating a startup, investors look for a strong team. Here are the most important factors they consider:

1. The team's qualifications

Venture capitalists and other startup evaluators are particularly interested in the team’s qualifications. They want to make sure that the individuals on the team have the requisite skills and experience to succeed in the company and the industry.

2. The team’s chemistry.

The team’s chemistry is also important. It’s important that the members of the team enjoy working together and support each other. A dysfunctional team will not be able to achieve much.

3. The team’s track record.

Another factor that’s important to investors is the team’s track record. They want to make sure that the team has a track record of success and is able to deliver on its promises.

The idea

Investors are constantly on the lookout for potential unicorns, or startups with a potential for immense growth. Accordingly, evaluating a startup entails taking into consideration a number of factors, including the idea.

One of the most important factors is the potential for the startup to revolutionize its industry. For example, if the startup is developing a new technology that could change the way businesses operate, this could be a major selling point for investors. However, just because a startup has an innovative idea doesn't mean it will be able to realize that idea. It's important to assess the feasibility of the idea and determine if the proposed solution is realistic and practicable.

Another key factor to consider is the market potential of the startup. Investors want to be sure that the startup's idea has the potential to reach a wide audience and generate significant revenue. In addition, they want to be confident that the startup has the ability to scale its operation and reach the mass market.

The Execution

In the startup world, the key to success is execution. Investors look for a clear and concise plan of execution when evaluating a startup.

Here are the key areas of execution that are essential to any startup:

Customer acquisition: How is the startup planning to acquire new customers? This includes identifying target markets and strategies for reaching them, as well as measuring customer acquisition costs.

Product development: How well is the startup planning and executing on product development? This includes developing a Minimum Viable Product, identifying key features and fixes, developing a pricing strategy, and launching the product to the market.

Operations: How well are the startup’s operations running? This includes identifying key metrics, setting up scalable systems, and hiring the right employees.

Financials: How healthy is the startup’s financials? This includes preparing and submitting periodic financial reports, forecasting future needs, and assessing potential risks.

The Market Potential

In today's business world, it is increasingly difficult for new businesses to break through and achieve widespread success. This is in large part due to the increasing competition amongst existing businesses and the growth of larger and more established companies.

As a startup business, your goal is to achieve as much market potential as possible. This means appealing to as many people as possible, and making sure your product or service is of high quality.

Here are four factors that investors look for when evaluating a startup:

1. Potential Market size and growth.

Investors want to know how large the potential market is for the startup's product or service. They also want to know how fast the market is growing, and whether there is potential for significant expansion.

2. Competitive landscape.

The competitive landscape is another important factor to consider. Investors want to know whether there are any existing competitors that could pose a threat to the startup, and whether there are any new players in the market with which the startup could compete.

3. Intellectual property.

Investors want to know whether the startup has any proprietary intellectual property (IP), and whether this IP is protected by copyright or other legal protection. If the IP is not protected, the startup could have trouble marketing and selling its products or services.

4. Financial stability.

Investors want to know whether the startup has a sound financial structure, and whether it is likely to be able to operate successfully in the long term. If the startup is unable to repay its debts or meet other financial obligations, this could lead to financial instability and potential investor fallout.

The Competition

When looking to invest in a startup, one of the most important factors to consider is the company's competitive advantage. Understanding why a particular startup has an advantage over its competitors can help identify potential investments and help the company to grow more effectively.

There are a number of different factors that can give a startup an edge. Some common advantages include strong market potential, strong customer relationships, strong technology or product innovations, or strong management.

It's important for investors to understand how a startup's competitive advantage could be leveraged to grow the business. For example, if a startup has a strong customer relationship advantage, it may be able to build loyalty among its customers and increase sales. In contrast, if a startup has strong technology innovations, it may be able to attract new customers by developing new ways to use its technology.

Competitive advantage is an important factor for startups to consider when evaluating their company. By understanding how different factors give a company an edge, investors can make better decisions about where to invest their money.

The Exit

An exit is the final goal of a startup. It can be anything from becoming profitable and going public, to being acquired by a larger company.

There are a variety of factors that investors look at when evaluating a startup's exit potential. These include the company's financial stability, the market potential of its product or service, and the team's track record of success.

One of the most important things investors look for is a company's runway. This is simply the number of years the company has before it has to run out of money. A company with a long runway is more likely to be successful and attract investors.

There are a variety of ways to measure a startup's runway. Some common metrics include: cash flow, financial ratios, and profitability.

Overall, investors are interested in knowing the potential of a startup, not just its current state. By evaluating the exit potential of a startup, they can help ensure a successful investment.