Small Business Consulting | 8 Crucial Tactics for Building Your Business

Starting a business is never easy. There are a lot of hurdles to overcome, but what you need to focus on is the vision of the future you are building and how to get there. If you do that, then all the other details that come with building a business will fall into place.

As a small business, you don't have the luxury of spending money on different channels of marketing and promotion. You need to make sure that you are getting the best ROI out of your marketing dollars.

Small business consulting services come at a price, but do not worry about it, this blog will give you have 8 tactics that will help you get prepare you for the business world.

This blog will focus on the following main points:

- Defining a small business

- Listing common challenges faced by small business owners

- 8 Crucial Tactics for Small Business Development

- How can a business management software assist

What is a small business?

A small business is a privately owned company or enterprise that typically has a small number of employees and limited revenue. It is usually independently owned and operated, with the goal of earning a profit by offering goods or services to customers. Small businesses often serve a local or niche market and play an important role in the overall economy, as they can create jobs, stimulate growth, and contribute to local communities. The exact definition of a small business can vary depending on factors such as industry, location, and government regulations, but in general, it is characterised by its size, independence, and entrepreneurial spirit.

What are the common challenges faced by small business owners?

Many small business owners often face a range of challenges that can hinder their business growth and success. Some common struggles include:

- Cash flow management: Small businesses may have limited financial resources and may struggle with effective financial management, particularly when it comes to meeting unexpected expenses or slow periods of sales.

- Competition: Small businesses often compete with larger, more established companies, which can make it difficult for them to attract customers and stand out in the market.

- Access to capital: Small businesses may have difficulty accessing the capital they need to invest in growth, whether it be through traditional bank loans or alternative sources of financing.

- Hiring and retaining employees: Small businesses may struggle to find and retain skilled employees, particularly as they compete with larger companies that can offer more competitive salaries and benefits.

- Marketing and advertising: Small businesses may have limited budgets for marketing and advertising, making it difficult for them to reach their target audience and build brand awareness.

- Compliance with regulations: Small businesses must comply with a range of regulations, from tax and labor laws to health and safety standards, which can be complex and time-consuming.

- Technology and innovation: Small businesses may have limited resources to invest in technology and innovation, which can put them at a disadvantage compared to larger companies.

These are just some of the challenges that small businesses may face, and the specific challenges will vary depending on the industry, location, and other factors. However, by overcoming these challenges, small businesses can achieve success and contribute to their communities and the economy.

8 Crucial Tactics for Small Business Development: consulting services

There are countless tactics that have been employed to help small business owners grow their business. Some of these tactics are more effective than others. In this blog, we will look at 8 crucial tactics that small businesses would probably require a small business consultant to help them with. These potential solutions might have a positive impact on your business and help you grow your business.

#1 Create A plan for the year ahead

As a small business owner creating a plan for the year ahead is a key step in setting your business on the path to success. Here are some steps to help you create a plan for the year ahead:

- First, set goals: Identify what are your business needs and what you want to achieve in the next year, both in terms of business growth and specific initiatives. Make sure your business goals are specific, measurable, achievable, relevant, and time-bound (SMART).

- Secondly, conduct a SWOT analysis: Consider your business's strengths, weaknesses, opportunities, and threats (SWOT) to understand your current position and identify areas for improvement.

- Thirdly, assess your resources: Evaluate your current resources, including your team, financial planning, and technology, to determine what you need to achieve your goals.

- Fourthly, develop a strategy: Based on your goals, resources, and SWOT analysis, develop a comprehensive strategy to guide your actions in the next year. This should include specific initiatives and action plans to support your goals.

- Then, allocate resources: Determine how you will allocate your resources, including your team and budget, to support your strategy.

- Finally, monitor and adjust: Regularly monitor your progress and adjust your plan as needed. This may involve pivoting your strategy, reallocating resources, or setting new goals.

By creating a plan for the year ahead, you can focus your efforts, prioritize initiatives, and ultimately increase your chances of success.

#2 Identify the right clients

Identifying the right clients is crucial for the success of your business. Having a clear understanding of what is important to your clients and how to approach them can help you build strong relationships and drive sales. Here are some steps to help you understand what is important to your clients and how to approach them:

- Know your target audience: Make sure you have a clear understanding of your target audience, including their needs, wants, and pain points. This information will help you identify the right clients and tailor your approach to meet their specific needs.

- Research your clients: Take the time to research your clients, including their industry, competition, and current challenges. This information can help you understand what is important to them and position your business as a solution to their problems.

- Communicate effectively: Choose the right communication channels to reach your clients and make sure you are communicating effectively. This may involve using different channels for different clients, such as email, phone, or in-person meetings.

- Offer value: Focus on offering value to your clients by providing relevant information, solutions to their problems, and exceptional customer service. This will help build trust and establish your business as a valuable resource.

- Listen to your clients: Make sure you are actively listening to your clients and taking their feedback into consideration. This can help you identify opportunities for improvement and make changes to better meet their needs.

By understanding what is important to your clients and how to approach them, you can build strong relationships and drive sales for your business.

#3. Get clear on your Product

Getting clear on your product or service is an essential step in building your business. A clear understanding of what your product is and what makes it unique can help you differentiate yourself from the competition and attract customers. Here are some steps to help you define your product or service and what makes it unique:

- Clearly define your product or service: Take the time to clearly define your product or service, including its features, benefits, and target audience. Make sure your definition is concise and easy to understand.

- Identify your unique selling proposition (USP): Your USP is what sets your product or service apart from the competition. Identify your USP by considering what makes your product or service unique, such as its features, quality, or value proposition.

- Evaluate your competition: Take the time to evaluate your competition, including their products, services, and marketing strategies. This will help you understand what they offer and identify areas where you can differentiate yourself.

- Communicate your unique value: Make sure you are communicating your unique value to your target audience. This may involve highlighting your USP in your marketing materials, website, and customer interactions.

- Continuously evaluate and improve: Continuously evaluate your product or service and make improvements as needed. This may involve adding new features, improving quality, or adjusting your pricing to stay competitive.

By getting clear on your product or service and what makes it unique, you can differentiate yourself from the competition, attract customers, and ultimately increase your chances of success.

#4. Identify your target market

Defining your target audience is an important step in building your business. Here are some steps to help you define your target audience:

- Identify your ideal customer: Think about who would benefit most from your products or services. Consider factors such as age, gender, income, location, interests, and pain points.

- Conduct surveys and focus groups: Collect data directly from your potential customers to gain insights into their needs, wants, and buying behaviors.

- Analyze your current customer base: Look at the demographics and behaviors of your current customers to identify common characteristics and patterns.

- Research your competitors: Analyze the target audiences of your competitors to understand the market and identify any untapped segments.

- Create buyer personas: Based on the information you've gathered, create detailed profiles of your ideal customers, known as buyer personas. These personas should include demographic information, pain points, and purchasing behaviors.

- Review and refine: Regularly review and update your target audience definition as your business grows and evolves.

By defining your target audience, you can create a more effective marketing strategy, develop products and services that meet their needs, and ultimately increase your chances of success.

#5. Prepare a marketing plan

Preparing a marketing plan is an essential step in reaching your target customers and growing your business. A well-thought-out marketing plan can help you effectively reach your target audience, increase brand awareness, and drive sales.

Once you have a clear understanding of your target audience and the market, it's time to create a marketing plan. This plan should include your marketing budget, channels for reaching your target audience (such as social media platforms, email marketing, advertising, etc.), and specific tactics for executing your marketing strategies.

It's important to regularly review and adjust your marketing plan based on results. Measuring the success of your marketing efforts will help you refine your strategies and make informed decisions about where to allocate your resources for maximum impact.

In conclusion, a well-prepared marketing plan is a critical component of growing your business and reaching your target customers. By taking the time to understand your target audience and the market, and by regularly reviewing and adjusting your sales and marketing tactics, you can increase brand awareness and drive sales.

#6. Evaluate your financial needs

Evaluating your financial needs is an important step in ensuring that you are financially prepared for your plan. Here are some steps to help you evaluate your financial needs:

- Create a budget: Create a detailed budget that includes all of your expected expenses and revenue for the year. This will help you understand your financial needs and identify areas where you may need to cut costs or increase revenue.

- Review your cash flow: Review your cash flow to understand when you will receive money and when you will need to pay expenses. This will help you identify any potential cash flow issues and plan accordingly.

- Consider funding options: Consider your funding options, including loans, investments, and grants. Make sure you understand the terms and conditions of each option and choose the one that best meets your needs.

- Plan for contingencies: Plan for contingencies by setting aside funds for unexpected expenses. This will help you weather any unexpected challenges and keep your business on track.

- Monitor your finances: Regularly monitor your finances to ensure that you are staying on track and making the necessary adjustments. This may involve adjusting your budget, seeking additional funding, or making other changes as needed.

By evaluating your financial needs, you can ensure that you are financially prepared for your plan and increase your chances of success.

#7. Build your team

Building a strong team is crucial for taking your business to the next level. Identifying your skills gaps and building the right team can help you achieve your goals and drive success. Here are some steps to help you build your team:

- Identify your skills gaps: Take the time to evaluate your skills and identify any gaps. This will help you determine what types of team members you need to hire to fill those gaps and bring additional skills to your business.

- Hire the right people: Hire the right people by considering their skills, experience, and cultural fit with your business. Make sure you are hiring individuals who are passionate about your business and share your vision.

- Create a positive work environment: Create a positive work environment by fostering open communication, providing opportunities for growth and development, and recognizing and rewarding employees for their contributions.

- Provide training and support: Provide training and support to help your team members grow and develop. This may involve offering regular training sessions, providing resources and tools, and offering opportunities for professional development.

- Empower your team: Empower your team by giving them the tools and resources they need to succeed, delegating tasks and responsibilities, and providing opportunities for collaboration and innovation.

By building the right team, you can fill skills gaps, achieve your goals, and drive success for your business.

#8. Stay motivated

Staying motivated is essential for achieving your goals and building a successful business. Here are some tips to help you stay motivated:

- Celebrate successes: Celebrate your successes, no matter how small. Recognizing your achievements can help you stay motivated and motivated to continue working towards your goals.

- Surround yourself with positivity: Surround yourself with positive people who support your vision and encourage you to keep going. Having a support system can help you stay motivated and overcome challenges.

- Keep learning: Keep learning and growing by reading, attending workshops and conferences, or seeking out mentorship. Learning new skills and gaining new knowledge can help you stay motivated and inspired.

- Take breaks: Take breaks and make time for self-care. Taking care of your physical, emotional, and mental health can help you recharge and stay motivated.

By staying motivated, you can keep pushing forward, overcome challenges, and ultimately achieve your goals and build a successful business.

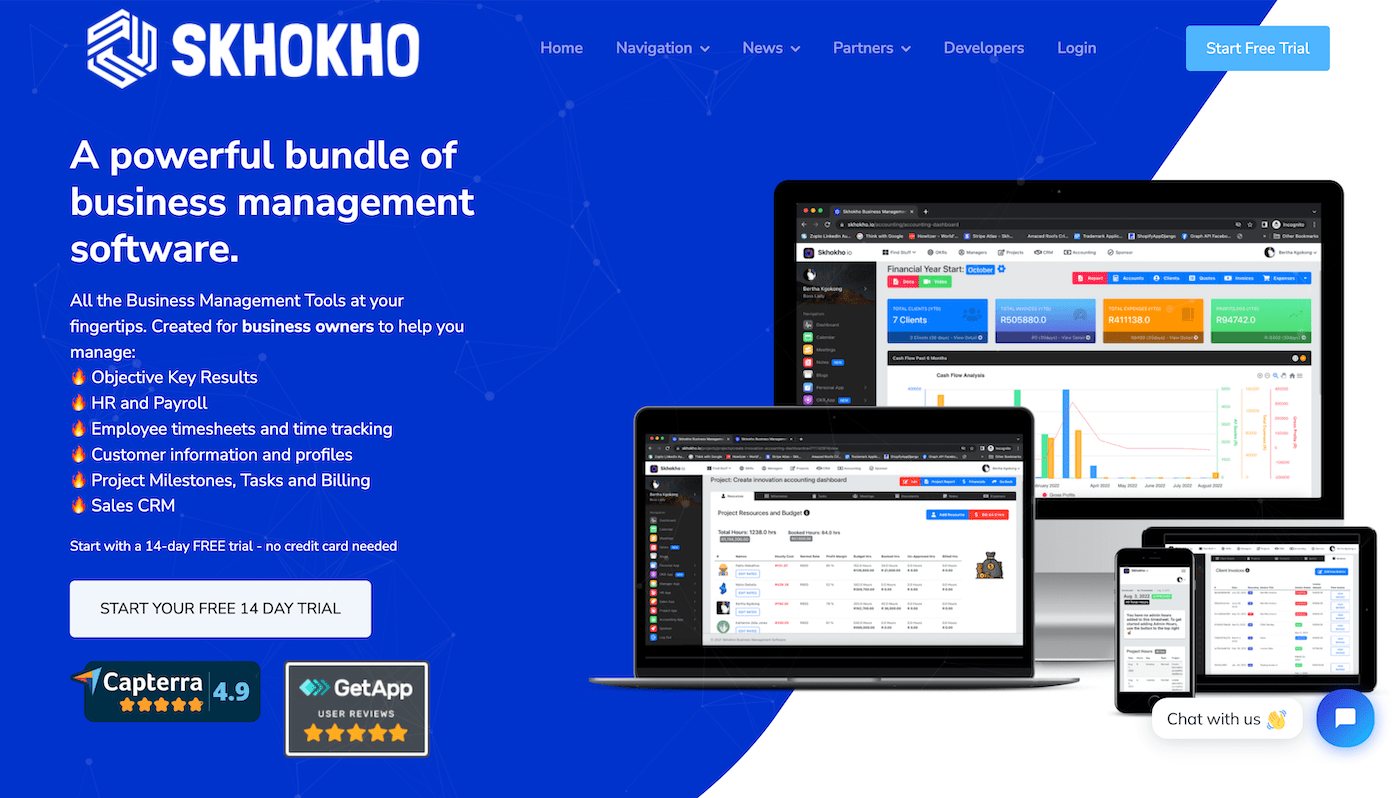

In what ways can a business management software assist?

A business management software like Skhokho can help in several ways, from employee management to financial management:

- Streamlining processes: Skhokho can automate repetitive tasks, such as invoicing and expense tracking, freeing up time for you to focus on other aspects of your business.

- Improving efficiency: With Skhokho, you can access real-time data and information about your business from anywhere, at any time. This can help you make better-informed decisions and improve efficiency.

- Enhancing collaboration: Skhokho allows you to share information and collaborate with your team, clients, and clients in real-time. This can help improve communication and reduce the risk of errors.

- Saving time and money: By automating processes and reducing manual work, Skhokho can help you save time and money. This can also help reduce the risk of errors and increase accuracy.

Improving customer service: Skhokho can help you manage customer inquiries and complaints, providing a more efficient and effective customer service experience.

In summary, Skhokho can help you manage your business more effectively and efficiently, freeing up time and resources to focus on growing your business and achieving your goals.

For more information, visit their website here. For a documentation that guides you on how to optimise Skhokho to it's full potential, click here.