How to create measurable objectives and key results for finance and accounting

This blog will cover a practical and step-by-step guide on how to create measurable objectives and key results for finance and accounting. The following topics will be covered:

- Background on OKRs and a discussion on why they are important

- How to create measurable objectives for finance and accounting

- How to create measurable key results for finance and accounting

- Monitoring and reporting on OKRs

- Practical examples of finance and accounting OKRs

The Importance of Measurable Objectives and Key Results

Objectives and Key Results (OKRs) are important elements of any organization’s strategic planning and performance management system. OKRs help organizations measure progress and identify areas of improvement.

Objectives are specific goals that an organization sets for itself and Key Results are the results that an organization expects to achieve as a result of meeting those objectives.

In order to get a clear picture of where your business is improving and where it needs to focus its efforts, adopting OKRs can be a powerful tool.

The benefits of using OKRs include:

- Objectives create focus and encourage team members to strive for greater success.

- They help management track progress and make optimizations as needed.

- They help to measure and compare performance against industry norms.

- They help to set aspirational goals for the organization.

- They create transparency and accountability for all members of the organization.

- They provide a framework for communication and collaboration.

- They help to measure the impact of strategy decisions.

There are a few things to keep in mind when setting up your own OKR system:

- Objectives should be specific, measurable and achievable.

- They should be relevant to the organization’s mission and vision.

- They should be updated and reviewed on a regular basis.

- They should be aligned with company goals and objectives.

How to create measurable objectives for finance and accounting?

When starting a new project or undertaking any kind of organizational change, it is important to have measurable objectives in place. Objectives can be divided into two main categories: strategic and operational.

Strategic objectives are the overarching goals of an organization. For example, a company might have a strategic objective of becoming the leading provider of healthcare services in its market. Operational objectives, on the other hand, are specific targets that an organization set to achieve specific goals. For example, an organization might have an operational objective of increasing sales by 10%.

To create effective objectives, it is important to first clarify the company's mission and vision. Once these are established, it is possible to create objectives that align with these goals. It is also important to define the resources available to the organization and the timeframe in which these resources will be used.

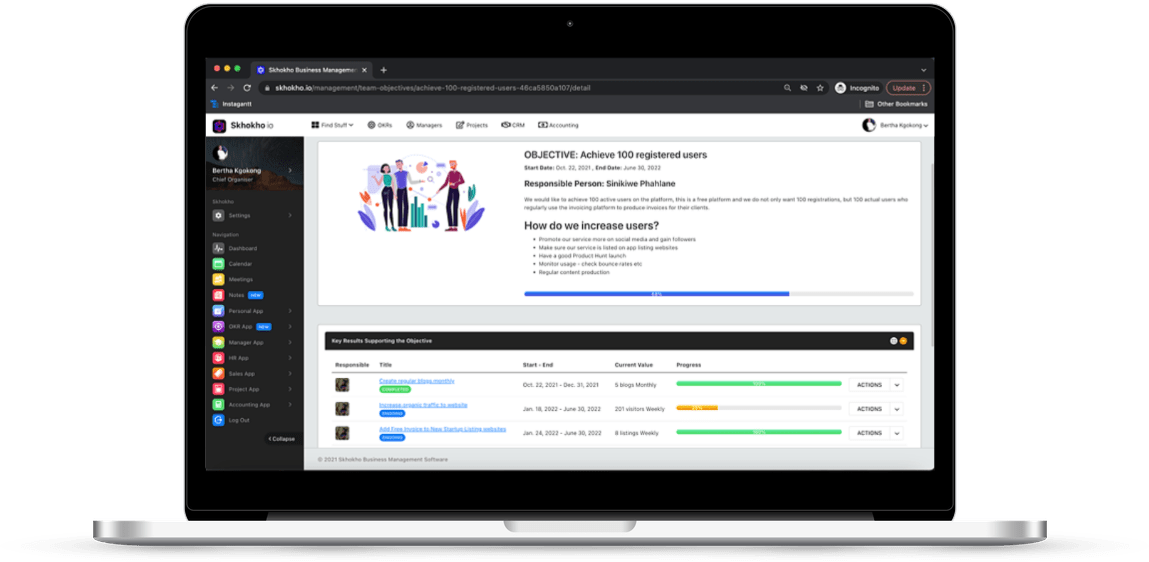

Once objectives are drafted, it is important to measure their progress regularly. This is where OKR management software - Skhokho comes in, Skhokho OKR app is created specifically for recording, reporting and management of OKRs.

Once progress has been measured, adjustments can be made to the objectives to ensure that they are still relevant and effective.

Overall, objectives are an essential part of any organizational change. By creating effective objectives, organizations can set goals that are achievable and measure their progress along the way.

How to create measurable key results for finance and accounting?

In order to create measurable key results for the finance and accounting department, it is important to establish clear financial targets and objectives.

It is also important to create a financial plan that reflects the department's goals and objectives. This plan should include projections for income, expenses, and capital expenditures. The plan should also be updated regularly to ensure that it remains relevant and accurate.

Finally, it is important to ensure that departmental employees are aware of the financial targets and objectives and are working towards meeting them. This can be done through training and seminars, as well as regular communication.

Here are a few tips to get started:

- Define your key results. You first need to define your key results. What are the specific metrics you want to track and measure? When you are creating your goals, objectives, and objectives for each department, make sure to include measurable key results that are relevant to your department.

- Create performance criteria. Once you have your key results, you need to create performance criteria for each metric. This will help you track progress and make sure that your key results are being met.

- Set deadlines. Make sure to set deadlines for each metric. This will help you track progress and stay on track.

- Analyze the data. Once you have completed your key results, it is important to analyze the data. This will help you identify areas of improvement and track progress over time.

Monitoring and Reporting Objectives and Key Results

The purpose of monitoring and reporting OKRs is to track progress and ensure that goals are met. Monitoring and reporting can be done in a number of ways. OKRs can be tracked online or offline. OKRs can be tracked with a spreadsheet or a computer program.

The most common way to track OKRs is to use an OKR software tool like Skhokho.

Skhokho has a built in OKR tracking system with the following features to support OKR development, management and tracking:

List your company strategic and operational objectives, for individuals, teams and department - this allows for collaboration, transparency and working with teams towards achieving goals

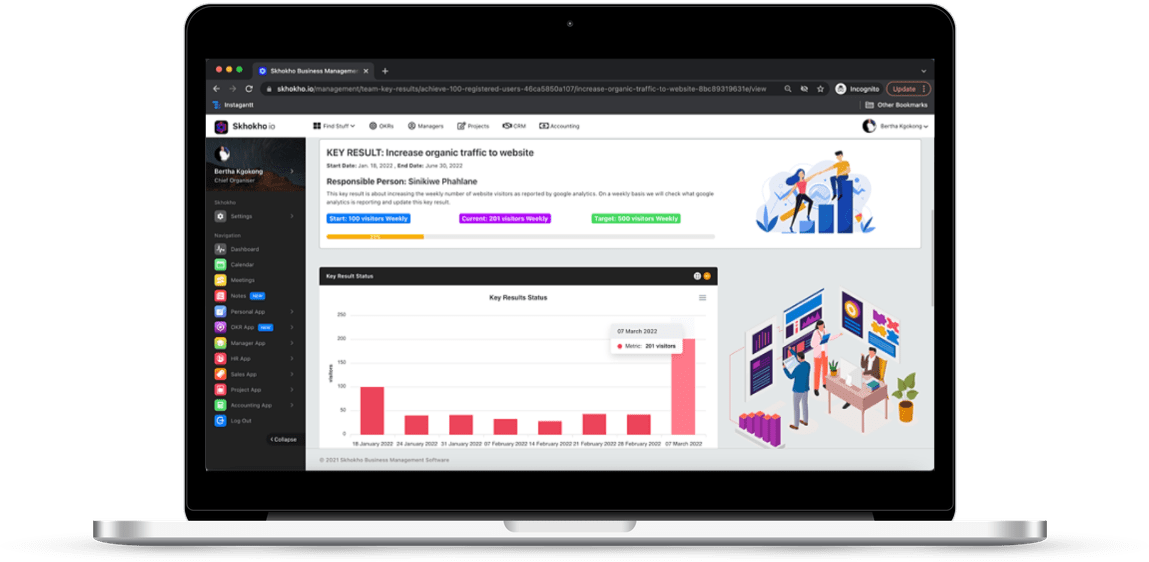

Real time reporting on goals, progress and targets. Each member of your team can view the current progress on targets at any given time.

SMART goals support - define the starting point, target and report on regular progress towards achieving the targets.

View the progress bar and responsible team members for achieving the goals at any given time.

Plot the progress on a timeline to help the team visualise the goals

Provide reports on key results updates, with feedback on what was done to push the targets forward at every reporting cycle

Task management system for OKRs, create to-do tasks that are specifically aimed at moving the goals forward.

Practical Examples of Finance and Accounting OKRs

Setting finance and accounting OKRs depend on your organisation, there is no one size fits all. However there are some guidelines on typical OKRs you can set to help you improve on your finance and accounting performance.

- In a company that manufactures athletic shoes, setting Objectives might include, for example, increasing sales by 20% every quarter. Key Results associated with this Objective might include reaching sales targets every month, quarter, or half-year.

- In a company that provides accounting services, setting Objectives might include, for example, slashing costs by 10% every quarter. Key Results associated with this Objective might include reducing spending on administration by 5% each quarter, or eliminating a certain category of spending altogether.

- In a company that operates a restaurant, setting Objectives might include, for example, increasing profits by 10% each year. Key Results associated with this Objective might include achieving a certain level of occupancy or revenue each month or quarter.

Get started with OKRs on Skhokho

Create a free trial account to get started today: https://skhokho.io/authentication/register

Read our OKR Documentation here: https://skhokho.io/documentation/okr/

Read more on OKRs here: https://skhokho.io/objective_key_results_okr_software