How to Get Your Small Business Ready for Investors and growth

In this article we will discuss the best ways to get your small business ready for investors and growth. Small business and growth go hand in hand. In order to survive, a small business needs an effective growth strategy - however statistics still indicate that the majority of small businesses fail within their first two years.

No matter what size your small business is, you will need to learn how to get investors. Another thing that is crucial when it comes to starting a small business is having the right tools in place.

There are many different things that you can do in order to get your small business ready for investors and attract the right ones. One of these things is make sure that your company has excellent branding and marketing materials. This will not only make it easier for others to recognize your company, but it will also make it easier for you to set up meetings with potential investors.

Let us start by discussing, what investors look for in a business. If you can understand what key points investors are looking for, you can better prepare your business for investment.

What are investors looking for?

- A unique business idea - Investors want to make money, by investing in your company - they are looking for a business idea that is has the highest chance for success. Unique business ideas generally will have less competition and hence a higher chance for growth and greater return on investment.

- Growth Potential - tying to the first point, the greater the growth potential, the happier the investor will be. A return on investment is how much money an investor can make after a certain period of time. Therefore business that can grow faster will be more attractive to investors. Take Netflix as an example, a company that started as a simple video rental service - grew to a $100billion company in 20 years.

- Management team experience and capability - This is an important variable that investors pay close attention to. An experienced management team can lead a small business to success - experience in the industry, market and client base is of crucial importance. Investors want to know that as a management team, you know what you are talking about. Experience can be directly attributed to chances of success for the business.

- Financial Performance - This is arguably the most important thing that investors look for, hence we saved it for last. Financial performance must be proven and documented. The business will need to show a sustainable recurring income and profits attributed to business activities over time.

What about Business Plans and Financial Projections

There might have been a time in the past when business plans alone could get your start-up investors, all you needed was good business idea - some marketing plans, revenue projections and you were good to go.

The risk of starting a small business, deters investors from investing in a business that does not have proven revenue, these days you almost always have to prove that you business idea can actually make money, has clients and that people are willing to pay for your product — before you start having any discussions with investors.

Business plans without actual recurring revenue are useless to investors, most investors will not invest in a pre-revenue business. This means that financial projections must be backed with actual revenue, and the current recurring revenue must be used to predict future potential revenue.

5 Important Tips on How to Prepare Your Business for Investors

1. Be prepared: Prepare yourself, your business, and its financial statements so you are ready when the investor comes knocking on your door.

2. Be open: Share all information about the company in an honest manner so that the investor can make an informed decision when investing in you or not.

3. Be realistic: Provide information about future opportunities in a realistic manner so that the investor is aware of what he/she is getting into with his/her investment.

4. Be transparent: Share all information with the investors about

5. Be yourself: Be true to your personal brand, pursue a business idea that you are passionate about.

Most Important Point: Get your financials in order - Getting your Business ready for investment

As discussed above, the most important thing investors look for is proven financial records and revenue generation. You have to show your investors that your business can make money, grow, get clients —— with actual revenue records.

Let us discuss the most practical way to prove your business is making money - MRR.

MRR - Monthly Recurring Revenue

This is a metric usually associated with Software as a Service businesses, however the principle of it can be applied to any business. MRR is a the revenue that a business consistently makes on a monthly basis. This stems from current and new clients, over time whether it is through monthly subscriptions, sales or retainer.

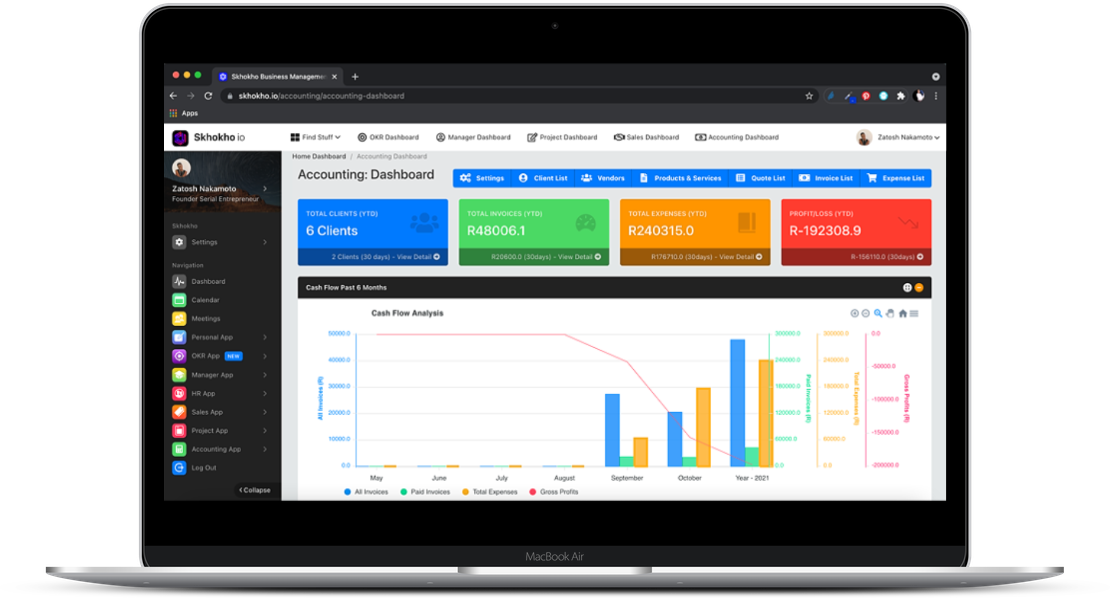

Use Skhokho Accounting to Record Revenue and Expenses

Most small businesses do not pay a lot of attention to accounting best practices, they usually employ accountants when they need to show investors their financials and accountants have nothing to work with, except for bank statements — which can miss a lot of business transactions.

What accounting software can allow you do to:

- Record business transactions as they happen: record revenue and expenses in real time and have ready to go financial statements at any given time.

- Have one place to go for historical records at any given time, all you would need to do is log in to your profile and view or print statements.

- Enable team collaboration: hey team member can input revenue and expenses as part of their day to day, you do not need to wait for an accountant.

- Cut costs and save money - by allowing your team to contribute to the production of financials.

Conclusion: Using Skhokho Business Management Software to Get your small business ready for investors

- Record invoices - create professional looking invoices, email them to your client and record your business revenue

- Record business expenses, employee expenses, approve or decline expenses online

- Prepare quotes for clients, email and record quotes

- Prepare management accounts for your business and accounting reports - based on the inputs to the financials

- Keep track of vendor and client records in one place

Get started by reading accounting app documentation here.