What are management accounts and what do they include?

Business management accounts are essential for any business that requires accurate, up-to-date financial information. In this blog, we will discuss the benefits of using business management accounts, as well as provide a step-by-step guide on how to create them.

Topic covered in this blog include:

- Management accounts and what they include

- Why are management accounts so important for your business?

- Common mistakes people make when preparing management accounts

- Get Skhokho to prepare your management accounts

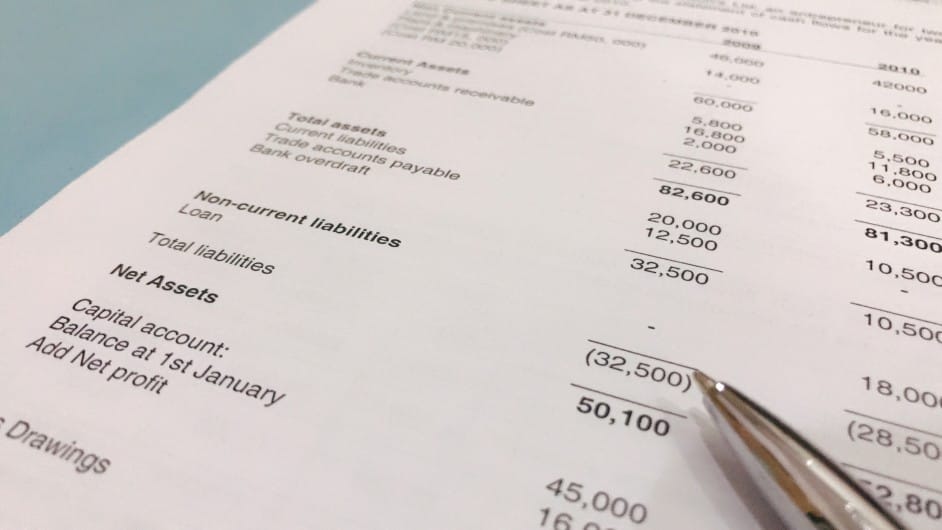

Management accounts are a way to track and report on financial performance of an organisation. They are also a key tool for financial decision making.

There are three main types of management accounts: financial, operational and performance.

- A financial management account allocates expenses and revenues between different financial assets and liabilities. This is used to track an organisation's financial stability and performance.

- An operational management account tracks an organisation's production and distribution. This is used to measure an organisation's efficiency and effectiveness.

- A performance management account tracks an organisation's progress in meeting its goals. This is used to make strategic decisions about the organisation's future.

In this blog, we are going to focus specifically on financial management accounts. In future we will cover operational and performance management accounts.

Financial management accounts and what they include

Financial Management Accounts (FMA) are a key component of financial planning and reporting. A financial management account includes a summary of all your financial transactions for a particular period of time. This summary can help you see where your money is going and help you make better financial decisions.

Some of the most common financial management account categories include:

- Your savings and bank balances

- Revenue and sales

- Cost of sales

- Administrative business expenses

- Operational business expenses

- The business assets - both current and non-current assets

- The business liabilities

- Owners equity

For example when it comes to revenue and sales - your business will need to record all the revenue that is generated within a specific time period. Revenue can associated with sales and other payments received by the business.

Within the same time period there will be changes to the business stock (from the sales above), these changes must be recorded within the stock-account, accounted for under current assets of the business.

In addition, the business will be required to pay salaries, and cover other costs. These costs must be accounted for between cost of sales and operational expenses and administrative expenses accounts.

Combining all these records for a business, constitutes the FMA of the business.

Keep in mind that FMA information is updated monthly, so be sure to check it and report new transactions as they happen to ensure that your management accounts are an accurate and true reflection of your business current financial state.

Why are management accounts important for businesses?

Management accounts are an important tool for businesses as they provide insights into the company's performance and financial position. They can help business owners to make informed decisions about the future of their company and how to improve its performance.

Management accounts include a range of financial information, such as income, expenditure and profit and loss. This information can be used to assess how well a company is performing and whether it is making a profit. It can also help business owners to plan for the future and make decisions about investment and expansion.

What are the most common mistakes businesses make when preparing management accounts?

The most common mistakes that businesses make with preparing management accounts are:

Failing to properly track expenses and revenues

When you do not have a system in place to record, approve and manage your financials, it is easy to lose track of your business expenses and revenue. This is especially prevalent in smaller businesses or founder run businesses. The records can exist in multiple locations, invoices in one place and business receipts in another.

The businesses will then spend a lot of money to hire accountants to prepare statements, only when required to do so by investors of banks. Mistakes can arise when accountants are preparing statements from bank accounts and other records that do not accurately reflect the day-to-day running of the business.

Not properly classifying expenses, and not properly allocating expenses between business units

The second most common mistake is the mis-allocation of transactions. When there is no system in place and you rely on your accountant, who must review months worth of records at a time - the chances that that, transactions are going to be mis-allocated, leading to an over-estimation or under-estimation of business financial position, affecting your chances of receiving funding.

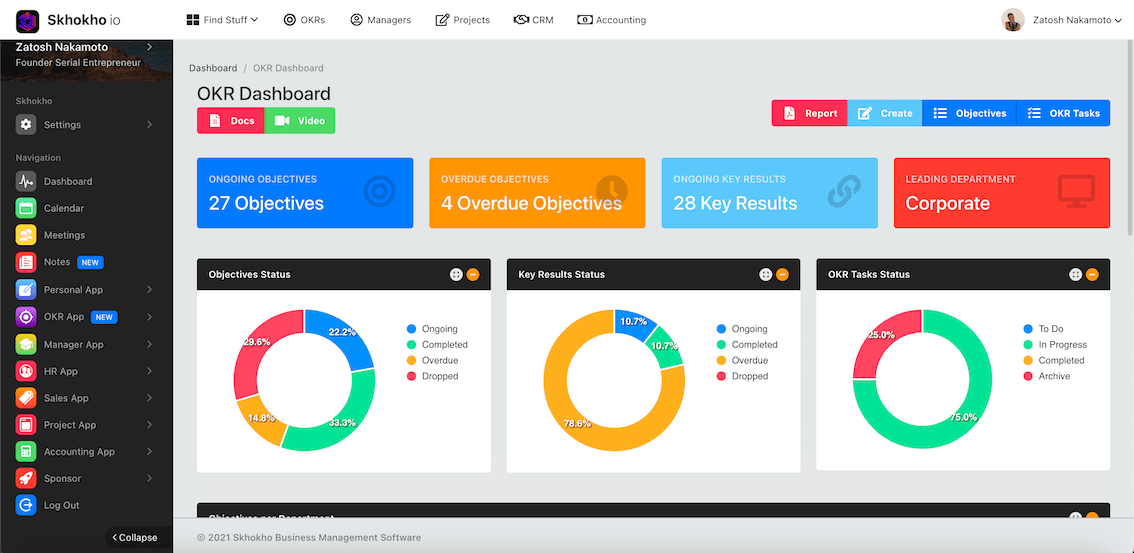

Failing to track financial goals and objectives

One of the most important elements in management accounts is financial goal-setting and tracking. It is often overlooked, because it is not a requirement of many investors or banks.

Skhokho has a built in goal-setting (OKR) app that can be easily integrated in to your accounting software and allow you to view your financial OKRs within your management accounts reports.

NOTE: Remember to classify the OKR accordingly as a financial OKR when creating it in the OKR app for it to be included in your management accounts.

Not taking into account employee salaries and benefits.

Employee salaries and costs need to feature in your business cost of sales report. There needs to be data-integration between your human resource management software (HRMS) and your accounting software, to allow you to accurately incorporate the cost data associated with Payroll towards your management accounts.

Skhokho has automated integration between the HRMS and Accounting software to allow for seamless data integration. If you have employees and set their salaries and payroll properly, this data will automatically be included in the cost of sales for your business and management accounts.

Get your Management Accounts done professionally with Skhokho Accounting Software

Get started with Skhokho accounting software today, to get your management accounts in order.

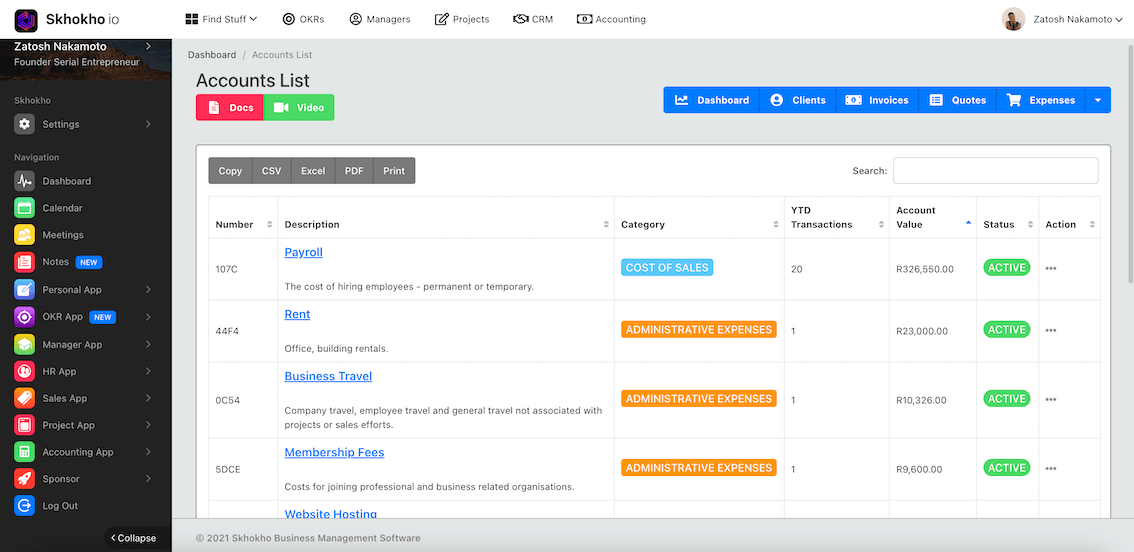

When you get started, the most common business accounts as discussed in section above will be created automatically for your business.

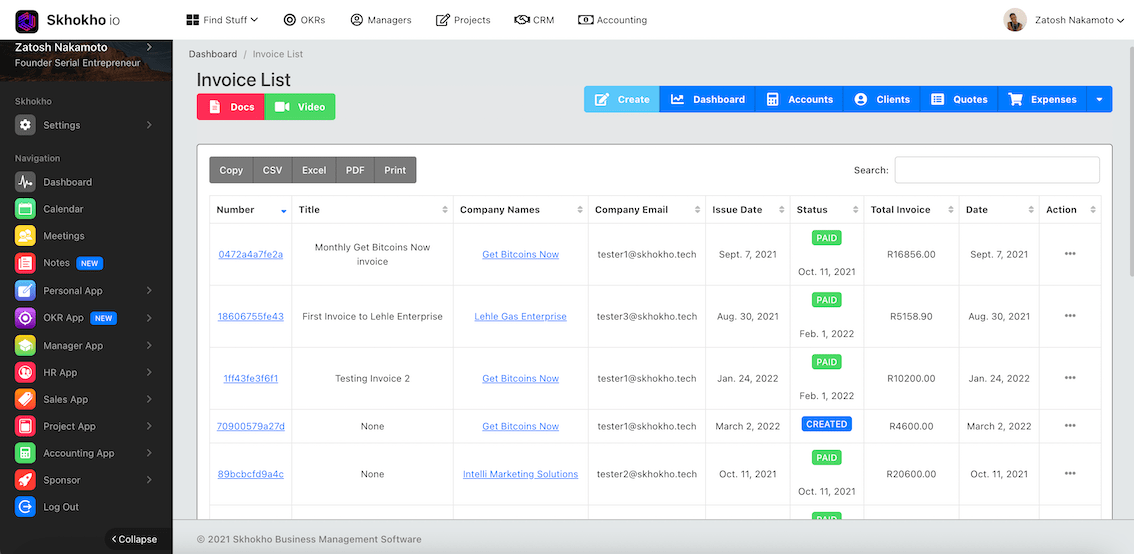

Business Invoicing

Skhokho software has a built in invoicing system. You can do the following:

- Create a client profile - address, contacts, etc.

- Create a new invoice and associate the invoice with a client and project

- Directly email the invoice to the client from Skhokho or print it out and send it yourself

- Update the status of the invoice to paid when paid

These invoices, once paid will be automatically added to the sales account for your business and recorded in the management accounts. Additional revenue by the business is managed via a separate revenue account.

Record Expenses

Expenses can be entered in the system from a couple of entry points: (1) employees can submit expenses, (2) projects can add project expenses, (3) sales and CRM app - employees can add expenses associated with leads and (4) accounting managers can add expenses directly from the expenses app.

These expenses already have built in expense accounts on Skhokho. Additionally the accounting manager can create new accounts, over and above the default accounts.

Set your Financial OKRs

OKRs can be set from within the OKR app. Objectives can be created for a team or individual, in addition objectives have to be assigned a department.

Objectives that are assigned to finance and accounting will be noted and included in the management accounts.

You can set OKRs for:

- Improving your revenue and sales

- Reducing your cost accounts

Issue a report

Management account reports can be produced directly from Skhokho, if and when required. They will gather data already in the system from invoices, expenses, payroll and OKRs.

In addition, you can add new accounts to track and update transactions manually to include in management accounts. For example, you can add a cash account - a bank account, and update it every time the balance changes to include it in your business assets for cash equivalents.

Register for 14 day free trial here: https://skhokho.io/authentication/register