Reduce operating costs | 10 tips | How To Reduce Operating Expenses

There isn't a business on this planet that wants to increase their operating expenses. As small business owners, you want to know how to run your business as efficiently as possible. That's why you need to know how to reduce operating costs. This blog will go over 10 tips on how to reduce operating expenses and drive your business growth.

We will cover the following:

- Introduction to Operational Expenses

- Defining Operational Costs

- Calculating Operational Costs For Small Businesses

- The Difference Between Operating Costs and Startup Costs

- How To Reduce Operational Costs And Expenses

- Invest in Technology

Introduction to Operational Expenses

Operational costs are the expenses which are related to the operation of a business, such as rent for office space, utilities, insurance, salaries, travel expenses and repairs. They are different from capital expenses, which are related to the purchase of equipment or property.

Operating costs can have a major impact on a business's profitability. In order to keep profits high, businesses need to carefully control their operating costs. There are a number of ways to do do cost cutting.

One of the most important thing to remember about operating costs is that they can vary greatly from one business to another. It is important to understand the unique operating costs of your business in order to make informed decisions about where to cut costs and how to increase profits.

You have to make sure that you have enough cash to keep the company afloat. You also need to make sure that your business can stay profitable so that you can keep funding your growth. One way to do this is to reduce your operating expenses. Operating expenses are one of the biggest expenses for any business.

What Are Operational Costs

In a business, operating costs refer to the cost of maintaining and administering the business on a daily basis. Operating costs include direct costs of goods sold (COGS) and other operating expenses frequently called selling, general, and administrative (SG&A) - which include costs such as rent, payroll, and other overhead costs, as well as raw materials and maintenance expenses. Operating costs exclude non-operating expenses related to financing, such as interest, investments, or foreign currency translation.

Calculating Operational Costs For Small Businesses

Operating charges are any expense that is necessary to keep your business running. The cost of goods bought is the main component of operating expenses (COG). CGs are direct costs associated with manufacturing your products or business services.

To calculate operating costs, you will need to first identify all of the expenses associated with running your business. Then, you will need to add up all of these expenses to get your total operating costs.

The formula: Operating cost=Cost of goods sold+Operating expenses

To get an accurate picture of your operating cost, it is important to track these expenses over time. This will allow you to see how your costs change as your business grows or changes.

An organisation can monitor its operating expense by using its operating expense ratio (OER).

The Difference Between Operating Costs and Startup Costs

An operating cost is an expense incurred by a business on a day-to-day basis. Startup costs are costs associated with starting a new business that a startup must cover. It will cost money for a business to get started even before it opens its doors or launches a new product.

Purchasing equipment, leasing office space, or paying employee wages may all be expenses the business must incur. In many cases, startup companies seek funding from investors or business loans to cover these costs. Unlike operating costs, which are paid from sales revenues.

How To Reduce Operational Costs And Expenses: 10 Tips

In the small business world, it is important you to do cost reduction for your business. Let me explain how to cut down on business expenses and get more profit.

The goal of reducing operating costs is to increase profits and cash flow. There are many ways to reduce operating costs, including improving efficiency, negotiating better prices, and eliminating waste.

1. Improve Efficiency

One of the simplest and most effective ways to cut operating costs is to improve efficiency. This can be done by streamlining processes and automating time-consuming tasks, investing in better technology, training employees or even outsourcing specialists for extra efficiency.

2. Integrate an Internship

Interns are a cost-effective way to lower costs. A new intern has limited work experience and is new to the job market. Through internships, they gain professional experience and business skills. Your business benefits as well.

3. Eliminate Waste

Operating costs can also be reduced by eliminating waste. This can be done by reducing inventory, streamlining processes, and improving quality control. You could also achieve this by shutting down all the unused services. Consider downgrading or cancelling them totally. Implement a lean management system. Lean management systems can help you eliminate waste and improve your efficiency.

4. Increase Revenue

Increasing revenue is another method to reduce operating costs. This can be done by increasing prices, improving sales, expanding into new markets and reducing overheads.

5. Introduce remote work if possible

It can be expensive to rent office space, pay utility costs, and maintain a physical workspace. The decision to do away with office space and operate entirely remotely has been made by thousands of businesses. Businesses can reduce their physical footprint and operating expenses by letting employees work from home.

6. Improve Cash Flow

Improving cash flow is another method to reduce operating costs. This can be done by increasing sales, decreasing expenses, spend money on marketing and and improving collections.

7. Reduce Debt

Reducing debt is another way to reduce operating costs. This can be done by paying down debt, refinancing, and negotiating better terms. You could also pay your bills in advance. Many suppliers may give you a markdown if you pay your bill ahead of time. Discounts of even 2%–3% per billing cycle can add up quickly.

8. Increase Prices

Increasing prices is another way to reduce operating costs. This can be done by raising prices, introducing new products, and expanding into new markets.

9. Reduce Taxes

Reducing taxes is another way to reduce operating costs. This can be done by taking advantage of tax breaks, negotiating better terms, and investing in tax-efficient products.

10. Invest in Technology

Investing in technology is another way to reduce operating costs. This can be done by automating processes, investing in better equipment, and developing new software.

Invest in Technology

We have listed 10 tips but we will go deep on one, "Invest in Technology"

You can reduce the cost of running your business by investing in the latest technology. There are many ways to do this, including:

Investing in Search Engine Optimisation (SEO) :

SEO can help you improve your website’s ranking in search engine results pages (SERPs). This can help you increase your website’s traffic and improve your visibility online.

Creating and maintaining blogs :

Blogging can help you attract new customers and generate leads.

Creating and managing a social media presence:

Creating and managing a social media presence can help you connect with potential and current customers.

Automating your processes :

Automating your processes can help you save time and money. It can also help you improve your customer service and increase your productivity.

Investing in cloud-based software :

Cloud-based software such as Skhokho can help you reduce your IT costs. It can also help you improve your business processes and increase your efficiency.

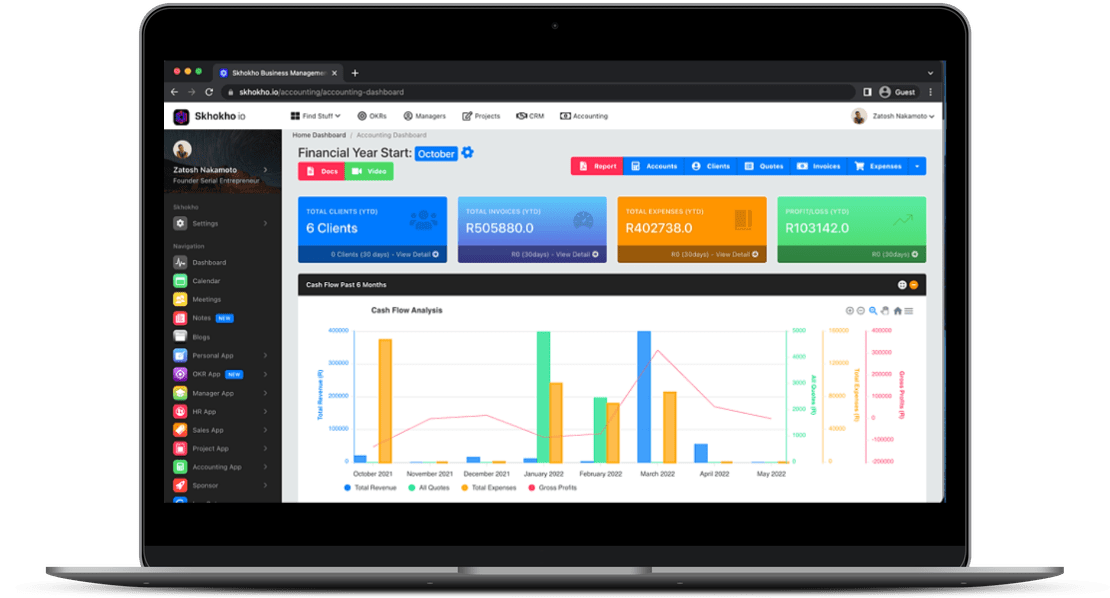

Skhokho Business Management Software

Skhokho is a powerful business management software. Unlike other business management programs, Skhokho can manage most of the day-to-day administration of your business in one place. Skhokho's comprehensive features make it easy to use even for beginners and non-tech people.

This software automate processes such as invoicing, reporting, email marketing and CRM management.

Skhokho integrated the following apps:

- CRM Software

- Project Management

- Accounting Software

- OKR Software

- Manager Software

- HR Software

- Meeting Management Software

You can handle all of your business administration, management, financial management, and reporting from one place. Most importantly, this software is very affordable and also offers a free 14 day trial.

To get started: click here to register and take advantage of your 14 day free trial: https://skhokho.io/authentication/register

For more information on how to use Skhokho, visit their documentation here: https://skhokho.io/documentation/guide/

Conclusion

There are many ways to reduce the cost of running your business. By investing in technology and automating your processes, you can reduce your operational costs. You can also reduce your marketing costs by investing in SEO, creating and maintaining blogs, and creating and managing social media presence.

In order to reduce costs for your company, it is important to first look at your expenses and define what is necessary and what can be cut out. It may be necessary to cut out unnecessary expenses that don’t add to the bottom line, while also looking at efficiency and making sure that all resources are used to the best of their ability.

In addition, it is important to have a clear understanding of the pricing of all goods and services that go into the creation of your products. After this, it is time to focus on the revenue side of the business. If you have a well-planned product, you should be able to find enough customers to support your business and make it profitable.