Best practices for maintaining client records for your small business

In this blog we will be discussing client records and best practices for maintaining client records for your small business.

According to the Small Business Association, “maintaining accurate and complete records is critical to the success of any small business.”

In this blog we are going to cover the following topics:

- Best Practice: Track of all communication with the client

- Project management software best practice for tracking project deadlines and deliverables

- Best Practice: Keeping track of all invoices and payments

- Complete client profile - 360deg view: Best Practice

By following these best practices, you can be sure that you are staying organized and on top of your client records. This will save you time and help you run your business more efficiently.

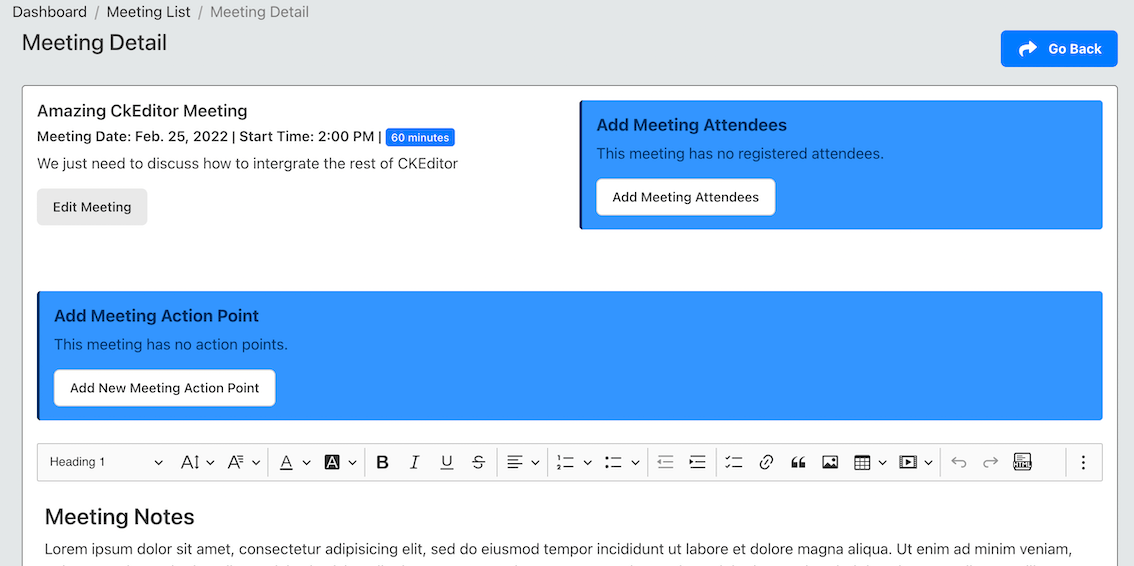

Maintaining Client Records Best Practice: Track all communication with the client

One of the requirements when maintaining client records is tracking all communications between your team members and individuals within the client organisation.

It’s important to track not only meetings and events related to the client, but also all email and phone correspondence. This ensures that everyone on your team is up to date with the latest developments and can provide the best possible service.

Skhokho Business Software has all the features required to help your team maintain client records. Your business can utilise the: (1) Meeting App to schedule, send invites and record minutes of meetings with the client and (2) Notes App to record more informal notes like phone-calls and observations.

Maintaining records in a central location ensures -

(1) data preservation when members enter and leave your team and

(2) that you can revisit historical data at any point to analyse it, draw insights and help you make better future decisions.

Best Practice: Store all client records in a centralised location.

Skhokho is a cloud software that can be accessed from any location with an internet connection. Skhokho utilises the best cloud security and firewalls to ensure that your client information is kept safe and secure.

Your team members can access Skhokho at any time allowing for collaboration, even within remote teams and modern working environments.

Best Practice: Keep records up to date.

Another important aspect of maintaining client records is keeping them up to date. This means ensuring that any changes to the client organisation are reflected in your records, and that any new contact details are added as soon as they become available. Keeping records up to date will help to ensure that your team always has the most accurate information available, and will make it easier to provide a high level of service.

Best Practice: Review and update records regularly.

Finally, it’s important to review and update client records on a regular basis. This will help to ensure that they remain accurate and relevant, and will also help to identify any areas where improvements could be made. Reviewing records on a regular basis will also help to ensure that your team is always aware of the latest developments within the client organisation, and can provide the best possible service.

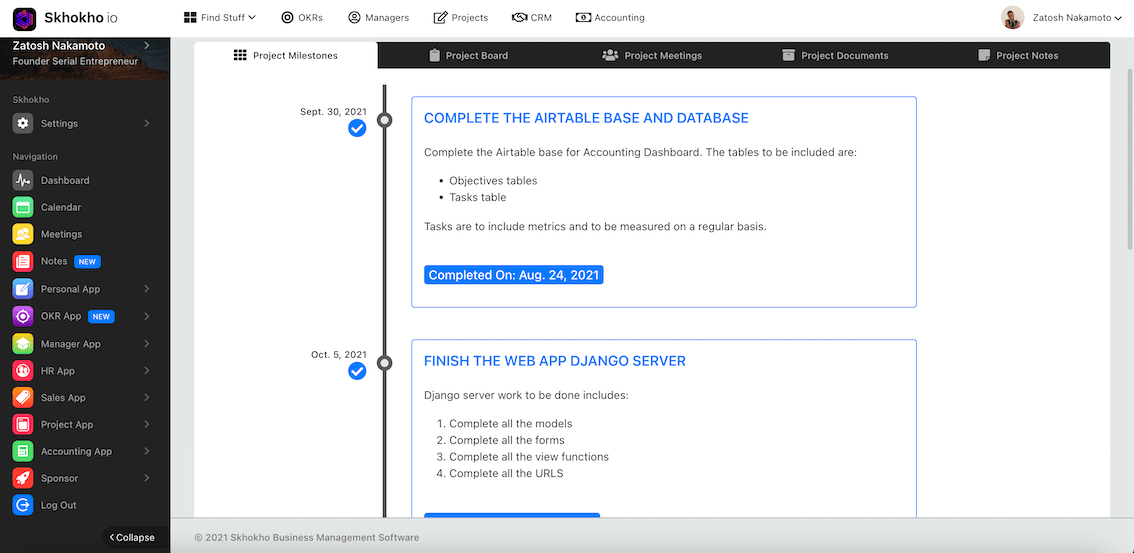

Maintaining Client Records Best Practice: Track client project deliverables details, milestones and dates.

It is important for small businesses to have tools, methods and systems in place to track client project deliverables, milestones and dates. This type of tracking system will help keep client projects and communications on track, and allow business owners to quickly reference information when needed.

Skhokho Business Software has a built in project management tool that was specifically created to:

- Allow you to create specific projects in a database - defining the project requirements, deliverables and scope.

- Enable you to specify milestones and dates for deliverables within your project.

- Allow your team to create specific tasks that can be tracked for each milestone.

- Produce project management reports with the above information on a project level and a department level.

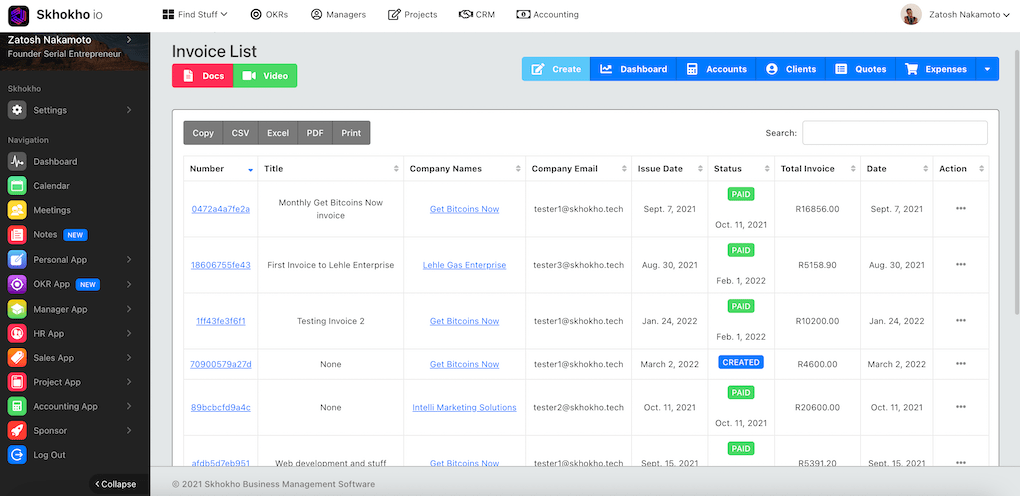

Maintaining Client Records Best Practice: Keeping track of invoices and payments.

When it comes to small businesses, keeping track of invoices and payments is essential to maintaining client records. If you don't have a system in place to track this information, you may find yourself scrambling to keep up with payments and invoices.

The benefits of keeping accurate invoice and payment records are:

- You can more easily track payments and invoices.

- You can follow up with clients who have not paid their invoices.

- You can avoid billing mistakes.

- You can keep track of your revenue.

- You can get an accurate record of sales to plug in to your accounting records.

Skhokho accounting software can help you achieve the above and more. This information is aggregated to produce an accurate client profile.

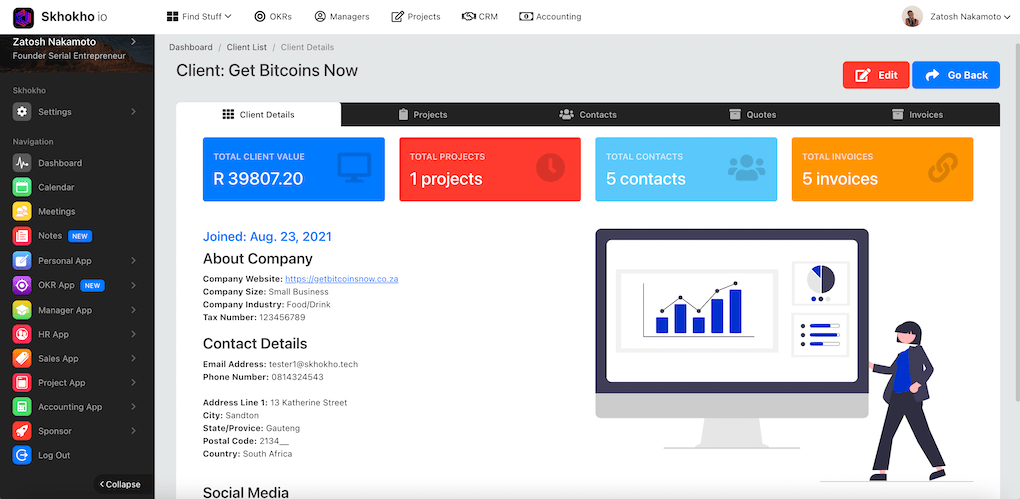

Bring it all together to get 360deg view of client data

A client record file should include, amongst other things:

- The name, address, and phone number of the client.

- Specific contact information, job titles or individuals within the client organisation.

- The date the client first contacted you.

- The date of the last contact with the client.

- A description of the services provided to the client.

- The amount of money charged for each service.

- Any payments made by the client.

- Any outstanding balance owed by the client.

- Quotations issued to the client in the past.

Accounting software like Skhokho helps you record and maintain these records within a digital client profile that is accesible to members of your team at any given time.

One of the main challenges of keeping client profiles up to date and accurate is that data is often gathered from different parts of the business:

- Sales department usually has the first contact with the client, and they record meetings, notes and sales efforts activities performed to acquire the client.

- Operations then work on delivering products and services to that client, and keep records of work done, projects and performance.

- Accounting is responsible for billing the client and record invoice data, bills, payment information etc.

It is important that the underlying data from these different activities in different departments and often different software is aggregated in one client profile, that your team can access and view a full 360deg profile of the client - from sales records, to projects delivered to the client, to financials and client value.

Skhokho provides an integrated approach to Business Management and seamlessly integrates the data from different business units in to one client profile dashboard.

This will ensure that that the client data is always accurate and up to date, but also accesible where needed.

Get started with Skhokho

Register for a free trial here:

https://skhokho.io/authentication/register

Read Skhokho Documentation: https://skhokho.io/documentation/guide/