Accounting for Small Businesses: Accounting practices that SMEs should abandon

Accounting is an integral part of any business that wants to make informed decisions. The problem is that accounting practices can get complex and complicated. SMEs struggle with the task of keeping track of all the financial documents and records and that's where accounting practices can make it hard to run your business.

As a small business owner, you have a lot on your plate. From keeping track of the product or service you offer to managing employee schedules, there's a lot to stay on top of. And, of course, there's also the financial side of things.

But don't worry, we're here to help. In this blog post, we're going to focus on the following:

- Defining what is small business accounting

- Business accounting basics

- The 6 basic accounts in business accounting

- Accounting practices that SMEs should abandon

- Choosing an Accounting Solution

- The best accounting softwares for small business

What Is Small Business Accounting?

Firstly, let us briefly explain what Accounting is: Accounting is the process of recording, classifying, and summarising financial transactions to provide information that is useful in making business decisions.

A business accountant needs accurate books keeping which includes the organization of all the and business transactions that are related to a business such as revenues, cash flow statements, business expenses, asset and liabilities. It’s important to start learning small business accounting terminology.

Small business accounting is the process of tracking the financial activity of a small business. This includes recording transactions, preparing financial & cash flow statement(s), and managing tax compliance.

Small business accounting is important because it provides information that can be used to make decisions about how to operate the business, how to allocate resources, and how to measure performance. It can also be used to assess risk and opportunities, and to make financial projections.

Business Accounting Basics

You should learn accounting basics so that your business operations are smooth. You must not compromise on the basics of accounting. Without a clear financial picture, your company may struggle. Below, we have listed some basic accounting principles.

In business accounting, the basic equation is always the same:

Assets = Liabilities + Equity

This equation is the foundation of double-entry accounting, which is the standard system used by businesses. In double-entry accounting, every financial transaction is recorded in at least two accounts. For example, when a business buys inventory on credit, the transaction will be recorded in the Accounts Receivable and Inventory accounts.

The left side of the equation (assets) represents everything the business owns. The right side of the equation (liabilities and equity) represents everything the business owes. Equity is the portion of the business that is owned by the business's shareholders.

The goal of business accounting is to produce financial statements that accurately reflect the financial position of the business. The most common financial statements are the balance sheet and income statement. The balance sheet shows the business's assets, liabilities, and equity at a specific point in time. The income statement shows the business's revenue and expenses over a period of time.

The 6 basic accounts in business accounting

Six types of accounts which make up The six basic accounts in business are:

- Accounts Receivable

- Accounts Payable

- Sales

- Expenses

- Assets

- Liabilities

Accounting practices that SMEs (business owners) should abandon

With accounting being such an important part of any business, it is important to use an accounting service that fits your business needs. Here's a list of accounting practices that SMEs should abandon.

There are a number of accounting practices that SMEs should abandon in order to improve their financial management. These include:

1. Not keeping accurate financial records

One of the most important aspects of financial management is keeping accurate financial records. This includes keeping track of income, expenses, assets, liabilities, and equity. Without accurate records, it will be difficult to make informed financial decisions and track the financial performance of the business.

2. Not preparing financial statements

Another important aspect of financial management is preparing financial statements. Financial statements provide a snapshot of the financial health of a business and can be used to make informed decisions about where to allocate resources. Without financial statements, it will be difficult to track the progress of the business and make informed decisions about the future.

3. Not budgeting

Budgeting is an important tool for financial management. It allows businesses to track income and expenses, and make informed decisions about where to allocate resources. Without a budget, it will be difficult to control spending and ensure that the business is operating within its means.

4. Not tracking cash flow

Cash flow is the lifeblood of any business, and it is important to track it closely. Without accurate records of cash flow, it will be difficult to make informed decisions about where to allocate resources and how to manage the business's finances.

5. Not using financial software

There are a number of financial software programs available that can help businesses manage their finances more effectively. These programs can automate many of the tasks associated with financial management, such as bookkeeping, invoicing, and tracking expenses.

Choosing an Accounting Solution

Using accounting systems is a simple process. Having considered a variety of accounting solutions can make the process more efficient and cost-effective. You're able to go out and do whatever you like knowing your financial destiny is safe.

- Decide which accounting solution is right for your business. There are many different options available, and each has its own advantages and disadvantages.

- Consider your business’s needs when choosing an accounting solution. You will also need to consider your budget. Some accounting solutions are more expensive than others.

- Decide whether you want an accounting solution that is easy to use or one that is more complex. Easy-to-use accounting solutions are often less expensive. More complex accounting solutions may be more expensive, but they may offer more features.

- Decide whether you want an accounting solution that is customizable or one that is not. Customizable accounting solutions allow you to add or remove features. Non-customizable accounting solutions do not allow you to customize them.

- Decide whether you want an accounting solution that is scalable or one that is not. Scalable accounting solutions can be used by businesses of all sizes. Non-scalable accounting solutions can only be used by small businesses.

- Decide whether you want an accounting solution that is easy to install or one that is more difficult to install. Easy-to-install accounting solutions are often less expensive. More difficult-to-install accounting solutions may be more expensive, but they may offer more features.

The accounting software should also be able to accommodate different types of businesses. For example, businesses that require accounting for payroll may require different features than businesses that require accounting for invoices. Businesses that require accounting for inventory may require different features than businesses that require accounting for accounts receivable.

Best Accounting Softwares For Small Business

Accounting is easier for a small company by using good software. What's the best way to start?

There is no one-size-fits-all answer to this question, as the best accounting software for small business will vary depending on the specific needs of the business. However, some popular accounting software options for small businesses include:

#1. QuickBooks

QuickBooks is an accounting software program designed to help small businesses manage their finances. The software includes tools for tracking income and expenses, managing customer invoices and payments, and preparing financial reports. QuickBooks also offers online banking and payment processing, payroll services, and other features.

QuickBooks can help business owners save time on bookkeeping and accounting tasks, allowing them to focus on running their business. The software can also help businesses keep track of their finances and better manage their cash flow.

There are a few disadvantages of Quickbooks, such as:

It can be expensive, especially for small businesses.

Quickbooks can be complex and difficult to learn, which can lead to errors and mistakes.

It can be time-consuming to set up and maintain.

#2. FreshBooks

FreshBooks is an online accounting software designed to help small businesses and freelancers manage their finances. The software is easy to use and provides a variety of features to help users keep track of their income and expenses, create invoices, and track time and project progress.

#3. Xero

Xero is a cloud-based accounting software that provides small businesses with a simple way to manage their finances. It offers features such as invoicing, tracking expenses, and creating financial reports.

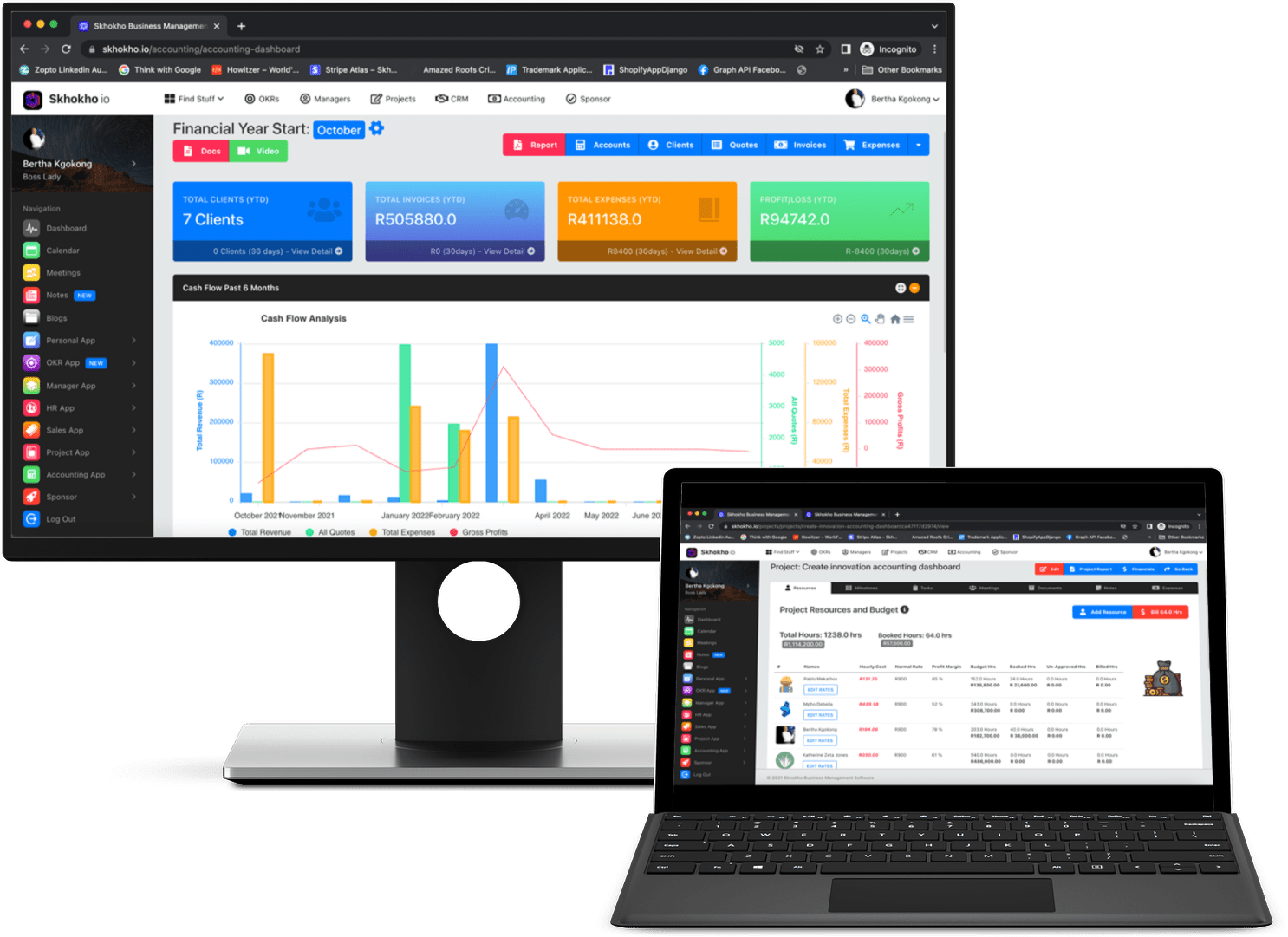

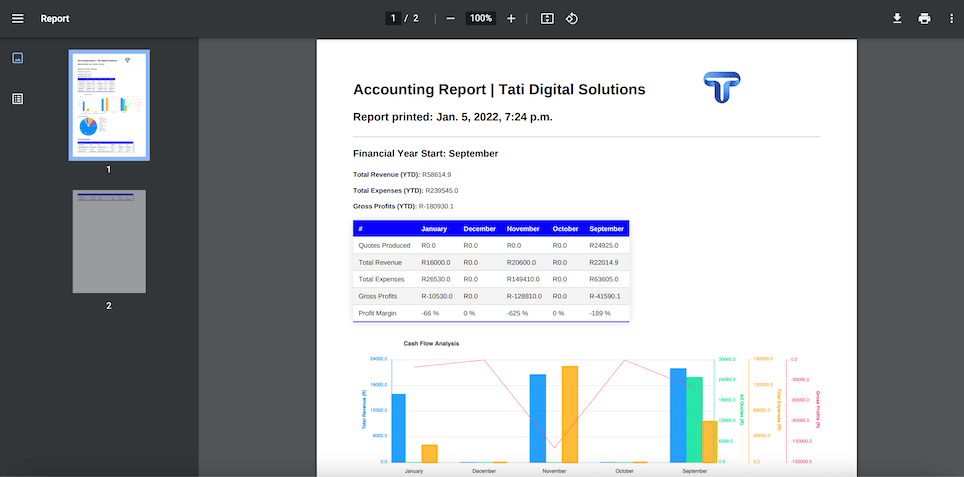

THE BEST: #4. Skhokho Accounting And Business Management Software

Skhokho Accounting And Business Management Software is an accounting system created especially for small businesses to help business owners process invoices and expenses. It helps you keep track of all your incomes and expenses in one place and manage your finances easily. This cloud-based solution offers powerful automation features for reducing time-consuming bookkeeping tasks and focusing on business growth. Not forgetting to mention that this software is very user friendly, making it easy to use even for a person with no tech experience.

Skhokho also offers a number of features to help businesses stay organized and efficient, such as the ability to create and manage projects, track time and expenses, and collaborate with team members. The software also integrates with a number of popular business tools, such as Google calendar, Zapier Platform and Sage, to make it easy to access and share files.

It also offers Simplified Accounting Reporting

(1) Create a report that outlines your revenue and expenses so that you can share it with your team and others. (2) Control your finances with easy-to-read reports.(3) Attract investors and customers: Show potential investors and customers your business's progress. (4)The dashboard allows small business owners to track all revenue and expenses for your business, saving you time and effort.

Skhokho offfers a 14 day free trial, no credit card information required, simply register today and get started! register here: https://skhokho.io/register

For more information on Skhokho Business Accounting software, click here, and for how to use Skhokho Accounting software click here.

Conclusion

If you are a small business owner, you may be particularly interested in the accounting practices you should avoid. It can be difficult to grow a successful business without the right help and advice. Fortunately, there are plenty of resources out there to help you along the way and make you a more successful business owner.